Angel Oak Mortgage Solutions taps into HELOCs

Housing Wire

JANUARY 30, 2024

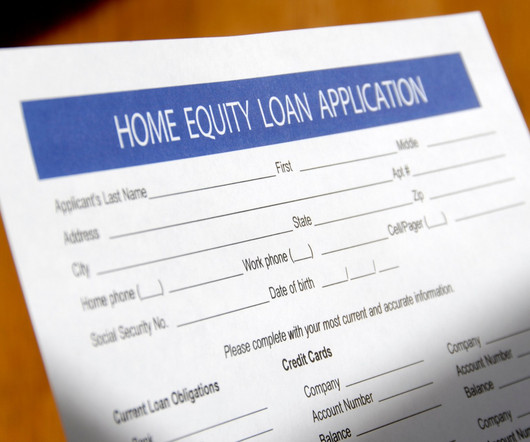

Atlanta-based nonqualified mortgage (non-QM) lender Angel Oak Mortgage Solutions is tapping into the home equity line of credit (HELOC) market amid elevated equity levels. Angel Oak’s bank-statement HELOC allows qualified, self-employed borrowers to leverage their home equity while maintaining their primary mortgage.

Let's personalize your content