The mortgage rate pendulum swings yet again

Housing Wire

APRIL 17, 2024

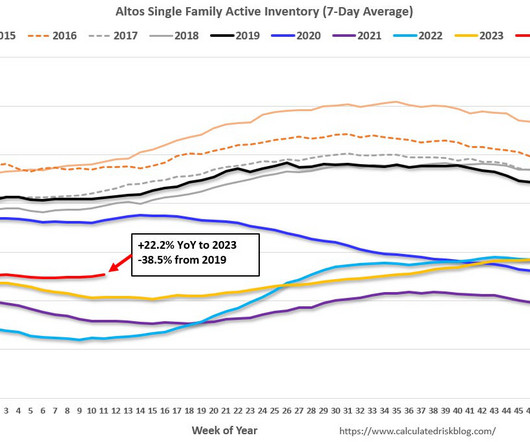

Mortgage rates hold major power in the housing industry; most importantly, high rates exacerbate the current affordability crisis by walloping the buying power of would-be buyers and discouraging some would-be sellers – those with low, fixed-rate mortgages – from listing their homes, a drain on available inventories.

Let's personalize your content