Top 5 mortgage terms to know before you buy a house

Housing Wire

DECEMBER 22, 2020

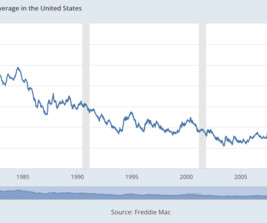

The mortgage application process can be a confusing one — especially if you’ve never gone through it before. Here are the top five mortgage-related terms you’ll want in your arsenal: 1. Here are the top five mortgage-related terms you’ll want in your arsenal: 1. Fixed-rate mortgage. Pre-approval.

Let's personalize your content