UWM to offer discounted rates on government loan refis

Housing Wire

DECEMBER 13, 2023

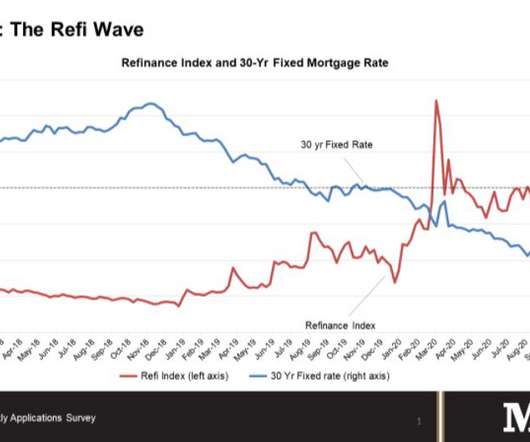

points – on FHA and VA refinances available to brokers until Jan. FHA rates were at 6.759% and rates for jumbo loans were even higher, at 7.333%. FHA rates were at 6.759% and rates for jumbo loans were even higher, at 7.333%. The initiative includes three new exclusive rates – 5.749% paying 1.5

Let's personalize your content