All-cash transactions gain traction amid high mortgage rates: Redfin

Housing Wire

NOVEMBER 10, 2023

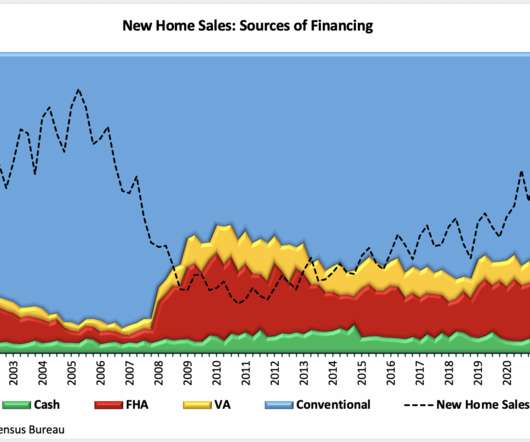

Home sales were down 23% year over year, but all-cash deals only fell 11%, according to Redfin’s analysis. It is worth noting that some buyers are using equity from the sale of their previous home to make a relatively larger down payment on their new purchase. mortgaged home sales, up from 14% a year earlier but down from 16.3%

Let's personalize your content