Fannie Mae’s chief economist on housing market outlook

Housing Wire

SEPTEMBER 22, 2023

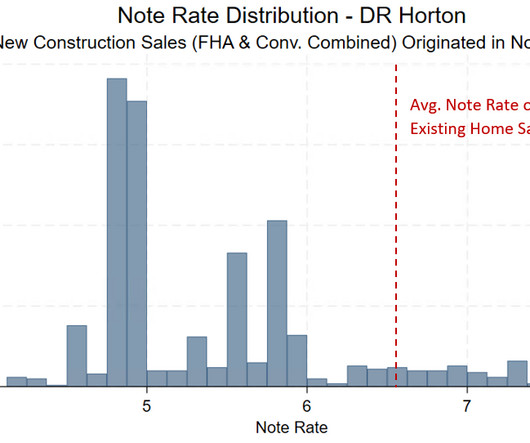

The Federal Reserve ‘s effort to temper inflation has cooled the housing market that remains subdued with mortgage rates north of 7%. this week, Fannie Mae Chief Economist Doug Duncan believes that mortgage rates will stay elevated before the Fed makes further rate cuts. “We’ve Kim: Spreads in the mortgage space are wide.

Let's personalize your content