Why Hometap is betting on the growth of the home equity investment market

Housing Wire

MARCH 8, 2024

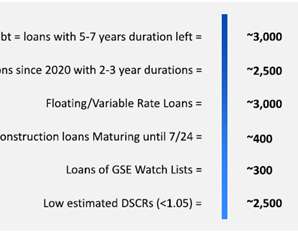

homeowners are “house-rich, cash-poor,” home equity investment firm Hometap provides clients with a way to tap into their home equity instead of selling their home or taking out a loan. I’m curious how Hometap is hedging against that risk. Based on the notion that far too many U.S.

Let's personalize your content