As we head into 2022, agents should be aware of the projected market outlook for the upcoming year

By Michelle Huffman

Whenever clients ask Joe Knab, CRS, when the market is going to slow down, he tells them: “A pandemic didn’t slow the market down, so I’m not quite sure what will.”

The RE/MAX Preferred Group and Cincinnati-based agent’s prediction—shared by agents, economists and researchers alike—is that the 2022 market will look fairly similar to today’s market.

The 2020/2021 market has been defined by “a lack of homes for sale relative to demand,” says Gay Cororaton, National Association of REALTORS® senior economist, director of Housing and Commercial Research. “This large demand-supply imbalance has resulted in strong price appreciation, waning affordability, tough competition among buyers and rising all-cash purchases.” And all this is likely to remain much the same in 2022, “although at a less torrid pace,” Cororaton says.

The 2020/2021 market has been defined by “a lack of homes for sale relative to demand,” says Gay Cororaton, National Association of REALTORS® senior economist, director of Housing and Commercial Research. “This large demand-supply imbalance has resulted in strong price appreciation, waning affordability, tough competition among buyers and rising all-cash purchases.” And all this is likely to remain much the same in 2022, “although at a less torrid pace,” Cororaton says.

“I expect that 2022 will still remain a seller’s market just because the inventory is still so low while mortgage rates are not likely to rise swiftly,” she adds. “The housing market will get less crazy as home prices cool a bit due to some softening in demand as mortgage rates start to increase and with some uptick in new home construction as prices of raw materials and supply-chain issues ease somewhat.”

Let’s take a look at the factors that defined this past year, which will likely define 2022’s national housing market outlook.

Prices will rise at a slightly slower rate

Most researchers agree that home prices will head upward in 2022, but not at the pace we’ve seen over the past two years.

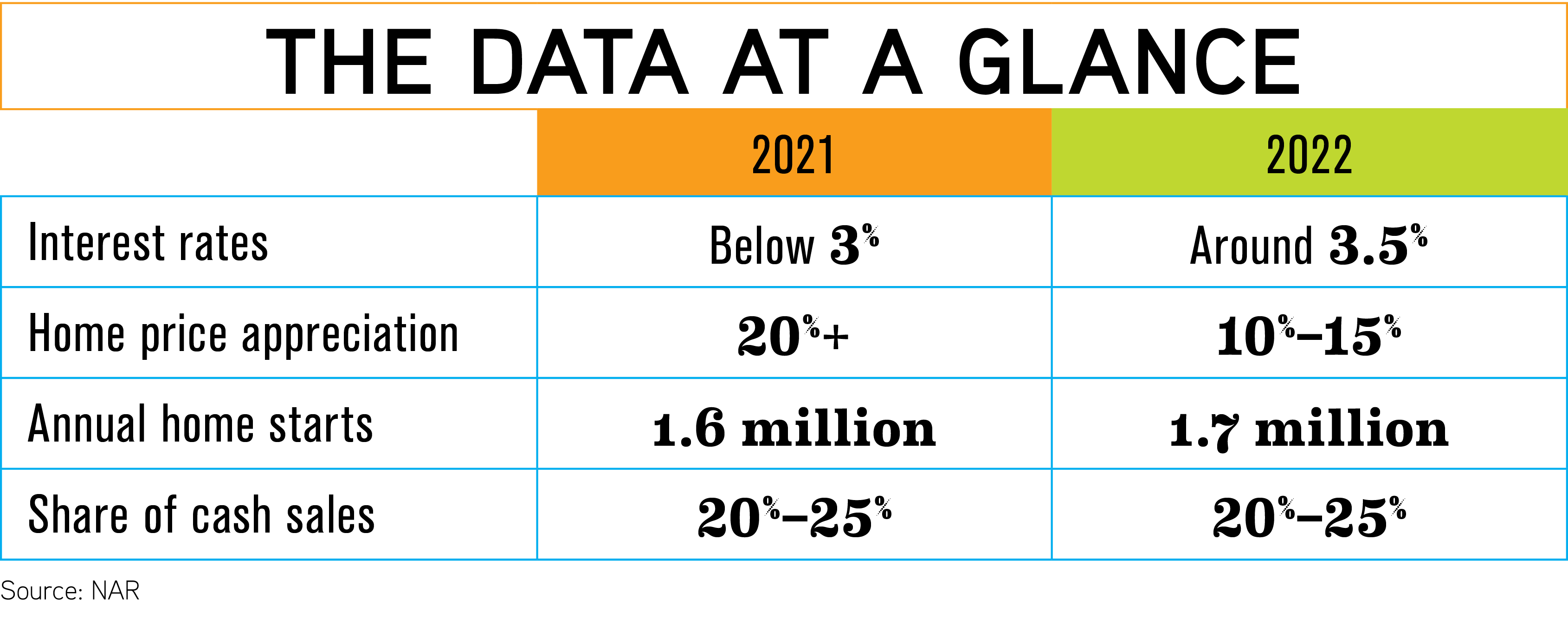

“Home prices are likely to appreciate at a slower pace of at least 10%, but 15% year-over-year growth is not out of sight,” Cororaton says. This past year, prices grew a whopping 24% at mid-year, the second-highest level recorded since January 1999, according to NAR.

The causes of 2022’s slightly deflated demand: a slight increase in both new housing starts and interest rates, as well as buyer fatigue.

Interest rates will rise, but not enough to dampen demand

Cororaton expects the 30-year fixed-rate mortgage to rise to 3.5% as the Federal Reserve “adjusts the Fed funds rate upward to cool off inflationary pressures.”

But Tim Freund, CRS, of Dilbeck Estates/Christie’s in Thousand Oaks, California, isn’t sure those rates will really put a dent in buyer demand. Small upticks in interest rates are likely to only push demand higher as buyers realize the “days of hyper-low interest rates are over,” he says.

“I do not anticipate a slowdown of consequence until rates reach 4.5% to 5%,” Freund predicts. Knab feels similarly that it would take at least a rate hike of 5% or more to show any effect in the marketplace. There are simply too many confluent factors stoking demand, they say.

“There are so many millennials starting household formation and buying their first home,” Freund says. Millennials are the largest adult generation at 72.1 million. Meanwhile, seniors are keeping their homes off the market by aging in place, and potential sellers are avoiding selling their homes because they fear the buyer’s struggle.

Tough competition for buyers will continue

There’s not a lot of good news out there for buyers: Competition will continue to be tough for homes that are simply getting more expensive. In mid-2021, the average sales-to-list price ratio was slightly above 100%, and, on average, there were five offers on a home sold, up from three offers in 2020, Cororaton says.

And in 2022, those offers will be tough to compete against, with all-cash offers continuing to make up a big chunk—about a quarter—of sales.

One stark example: “Current homebuyers have built a lot of home equity in the past decade,” Cororaton says. “Just in the past five years alone, a person who bought a home in San Francisco would have home equity of over $500,000. Movers from these markets can use the home equity gains to make an all-cash offer

in less expensive metro areas.”

Housing starts will grow, but not as much as they need to

New home construction has been growing—a much needed relief for many markets. The 1.6 million housing starts in mid-2021 was 15% over the 1.38 million at the same time in 2020. Housing starts will continue to tick upward in 2022, from 1.6 million to 1.7 million, Cororaton says.

But, unfortunately, it’s still not enough.

“The underbuilding in the last 20 years is so huge, at 5.5 million to 6.8 million,” Cororaton says. To address that underbuilding, 500,000 new homes have to be built in the next 10 years, on top of the 1.6 million current annual pace.

But there are key constraints, namely labor and lumber. In labor, there are 330,000 fewer people employed in specialty trade construction compared to 2005. Lumber prices are starting to come down, although prices remain elevated (+125% year-over-year).

A massive correction, like a housing crash, is extremely unlikely

Although all these factors together seem to point to a superheated market like we saw in the mid-2000s, there is no bubble about to burst.

“To the question of forbearance and foreclosure, aside from the fact that a majority of those distressed property owners have significant enough equity to sell for a profit, just ask any REALTOR® how many of their investor clients are champing at the bit for the first sign of market decline,” Freund says. “It’s fair to say investor interest, including Wall Street hedge funds, will dull any significant risk of steep market correction.”

The reality that many agents are sharing with their clients: The bad loans being made back in the early 2000s are no longer being made. The crash that followed won’t happen now—even if some first-time buyers would welcome it.

All this points to a market similar to the one we’ve seen over the past two years.

Enjoy this article? If you are interested in preparations for 2022 regarding taxes, check out Tax Talk 2022, available at CRS.com/webinars.

Photo: iStock.com/KaanC/Evgeny Babaylov/fonikum