Does inflation cause mortgage rates to rise?

Many people think of inflation in terms of day-to-day prices: the rising cost of a gallon of gas, for example, or a loaf of bread at the store.

Mortgage rates might seem further detached from price pressures. But in fact, the two are closely related.

The basic concept is that mortgages behave just like bonds: when inflation rises and purchasing power falls, interest rates must also rise to keep investors interested.

Post-COVID inflation fears have many predicting higher mortgage rates in 2021. The question now is how quickly — and how much — both numbers will rise.

Find a low mortgage rate todayIn this article (Skip to...)

- Inflation and rate trends

- What is inflation?

- How inflation affects mortgage rates

- COVID-19 and inflation

- Will rates keep rising?

- How it affects you

Inflation and mortgage rate trends

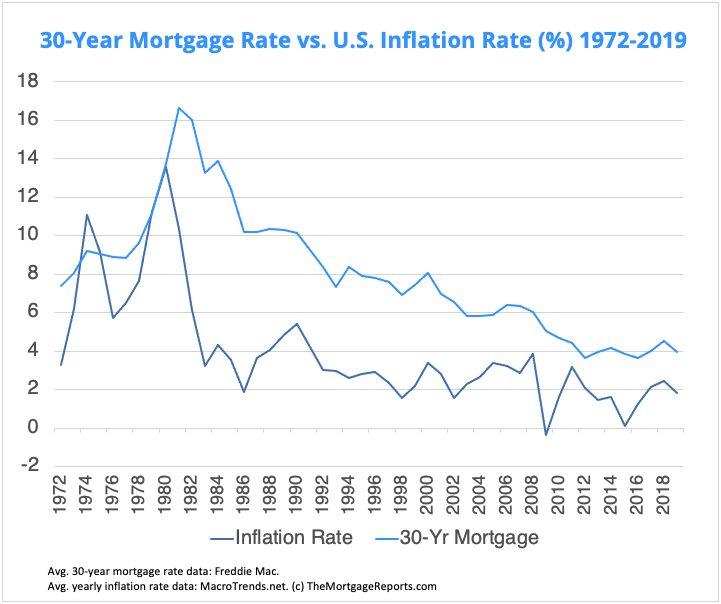

It’s not hard to spot the relationship between mortgage rates and inflation.

Compare a historical graph of one with the other, and it’s plain to see how mortgage rates and inflation move more or less in sync.

At the time this article was written, there was a growing fear of future inflation among the investors that ultimately determine mortgage rates.

Many believe an influx of cash from COVID stimulus plans, along with a continued low-rate policy from the Federal Reserve, could cause inflation to skyrocket in 2021.

This fear alone has been enough to push mortgage rates higher in some weeks.

But, at other times, inflation fears have served only to prevent rates from falling too far.

Why’s all this happening? And how likely is it we’ll soon be seeing noticeably higher mortgage rates? Read on to find out.

Lock in at today's low mortgage rates. Start here

What is inflation?

Inflation is defined as, “a general increase in prices and fall in the purchasing value of money” by Oxford Dictionaries.

To illustrate: Inflation in the US spiked at 13.55% in 1980. So in 1980, your dollars would have bought you 13.55% less at a store than they would have in 1979. To look at it another way, it would have cost you 13.55% more to buy the same things — $113.55 instead of $100.

That’s what it means for the same amount of money to have a reduced purchasing power.

Since 1980, inflation has steadily fallen. Its highest point since then was 5.4% in 1990. Since 2011, it’s jogged along at a rate of roughly 2% or below.

As a result, many of us have forgotten to be concerned about inflation. But investors haven’t. And neither has our central bank, the Federal Reserve.

How does inflation affect mortgage rates?

Inflation has a powerful influence on mortgage rates. And that’s because mortgage rates are determined by the bond market.

Just like 10-Year Treasurys, for example, investors purchase bundles of mortgages (called Mortgage Backed Securities or MBS) and profit from the interest paid on them.

In other words, mortgages are constantly bought and sold by investors.

Mortgage investors focus on future returns

We said investors have a long memory when it comes to inflation. And you can see why.

Suppose you bought a fixed-return asset such as an MBS or U.S. Treasury bond today. You might get a yield (an annual return) of something over 2% on MBS and 1.6% on a Treasury bond, based on figures for mid-May 2021.

But, if you’re an investor worried that inflation might become high, you won’t want to buy long-term, fixed-yield assets. Because your 1.6% or 2% yield may not buy you much in 2, 5, or 10 years’ time.

Worse, bond yields pretty much always rise in line with the inflation rate.

So you could find yourself stuck with a bond yielding 2% for up to 30 years, when in a few years, yields might be two or three times as high — or even higher.

When investors are avoiding such bonds, yields (and the rates borrowers pay) go up. Because sweetening the deal is the only way to attract reluctant investors.

Of course, if you already have a fixed-rate mortgage loan, your monthly payments won’t be affected. But when you decide to buy a house or refinance, you could be on the hook for higher rates if inflation has increased.

Do mortgage rates always increase with inflation?

For the most part, yes. You typically get higher mortgage rates during periods of high inflation and lower ones with low inflation.

However, responsible economists rarely use the terms ‘always’ or ‘never.’ And that’s because nothing’s ever certain in the world of economic forecasting.

During the period of post-pandemic recovery, things are especially unpredictable.

Mortgage rates haven’t always reacted to economic news as expected. And investors and economists are split on whether we’ll see runaway inflation or — as the Fed believes — price pressures will be only temporary.

COVID, inflation fears, and mortgage rates

Why is COVID-19 driving inflation?

The COVID-19 pandemic has been a major driver of recent inflation.

First, coronavirus created a need for massive government spending on fighting the pandemic and providing relief to Americans who’d suffered economically.

But COVID also created other problems as the medical emergency receded.

For example, supply chains were disrupted as our domestic economy — as well as foreign economies — struggled to reboot. So car plants were left idle owing to a shortage of processing chips. And prices of metals, lumber, and other raw materials shot up, purely because demand outstripped supply.

Almost as importantly, US employers struggled to restaff having previously laid off workers.

Together, these pandemic-related drivers have undoubtedly pushed up the inflation rate.

What to expect in the coming months

At the time this was written, the rate of inflation was running just a little warm. But markets were still obsessed with inflation.

According to Bureau of Labor Statistics data related to April 2021:

“Over the last 12 months, the all items index increased 4.2 percent before seasonal adjustment. This is the largest 12-month increase since a 4.9-percent increase for the period ending September 2008.” —BLS

So markets are obsessed because they’re concerned about future (rather than actual) inflation.

Investors would say they’re looking ahead and adjusting their strategies to accommodate a future threat.

But there’s a danger that groupthink about inflation could turn fears into a self-fulfilling prophecy.

On May 13, 2021, New York Times economic correspondent Neil Irwin wrote: “Professional inflation-watchers are on close watch for signs that these forces might be unleashing a form of thinking about price dynamics unseen since the early 1980s, when prices rose in part because everyone expected them to.”

The question is, will this be a short-term, one-time adjustment? Or might it turn into something that brings a consistently higher inflation rate for years to come?

Nobody knows. But the Fed is confident this is just a temporary blip.

Will mortgage rates keep rising in 2021?

Nobody can ever be certain about the future direction of mortgage rates. But, if inflation does take hold, it’s beyond highly likely that mortgage interest rates will keep rising.

They may well climb higher even if the Fed is right about inflation cooling off within a few months.

That’s because economic growth typically brings higher mortgage rates. And nearly all economists believe a boom is imminent.

Could mortgage rates fall in 2021?

Rising rates seem likely, but aren’t guaranteed. Why? Because there are plenty of threats to the U.S. economy that could arrest increases and perhaps even send rates lower.

For example, suppose some future variant of SARS-CoV-2 (the virus that causes COVID-19) emerges that turns out to be resistant to vaccines.

If that were also highly transmissible, it could set back all the progress and recovery we’ve made since March 2020 — at least until new vaccines are developed.

Or imagine if enough investors suddenly decided that the stock market is an overinflated bubble and pop it. That, too, would be an enormous setback for the economy that’s entirely independent of the pandemic.

Now, you may think those threats are way less likely than either more inflation or a boom. And this writer would agree with you. But neither the two threats above nor others are unthinkable. It’s possible they could happen.

And that’s why future mortgage rates can never be predicted with absolute certainty.

How does all this affect you?

Learning about inflation and mortgage rates can help you understand what’s happening in the bigger economic picture.

But what does it all means for you? How does inflation affect your own home loan and your current or future mortgage payments?

If you’re refinancing, when should you lock a rate?

Choosing when to lock your mortgage rate is always a gamble. You weigh the odds of different scenarios arising and of the different risks and rewards they present.

For example, it usually makes sense to lock your mortgage if you think rates are likely rise. And if you believe rates will full substantially? You might wait.

But there’s never a “right” answer. Because, as we said, there’s never any guarantee about how rates will move from one day to the next.

The Mortgage Reports provides advice — updated every business day and on Saturdays — on what we think may be the smartest move: to lock your rate or to continue to float it.

You can visit that page as a resource, and keep popping back until you’re ready to lock.

Check your mortgage rates todayIf you’re deciding when to buy a home

Home buyers might be thinking now is a bad time to get into the real estate market.

Mortgage rates were at the time this was written than they were for much of 2020. And home price rises are trending upward, too.

CoreLogic reckons: “Home prices nationwide, including distressed sales, increased year over year by 11.3% in March 2021 compared with March 2020 and increased month over month by 2% in March 2021 compared with February 2021.”

But it only makes sense to delay if you believe mortgage rates are going to fall and home price rises are going to moderate or drop.

it only makes sense to delay if you believe mortgage rates are going to fall and home price rises are going to moderate or drop... Neither looks likely right now.

Both of those could be possibilities. But neither looks likely right now.

So likely the best way forward is to grab your place on the first rung of the housing ladder as soon as you can.

That might even mean choosing a more modest home than you’d hoped for, if prices in your area are out of reach. But remember — you can always trade up to your dream home once you’ve benefitted from the rising home prices and home equity gains that are currently your enemy.

For more help on this topic, see:

- What first-time buyers should know in 2021

- 5 Reasons it’s not a horrible time to buy a house

- Is buying a house a good investment?

The bottom line is that buying a home is a huge financial decision.

You should time your purchase for when you’re financially and emotionally ready — not based on slight changes in the interest rate market.

Time to make a move? Let us find the right mortgage for you