What’s the best film trilogy of all time?

Many of you are going to say Lord of The Rings, and that’s fair, although I consider that to be the same movie divided into three. And that’s unfair of me to say, since I only saw the first film (and didn’t like it), and I also don’t support the “fantasy” genre.

Star Wars comes to mind, but that was a trilogy until they made three prequels, then George Lucas sold his company, and they’ve since made countless sequels and prequels.

Most people will say The Godfather, and since Godfather II won “Best Picture,” I can see this trilogy as a real candidate, even though Part III was poor.

Any Clint Eastwood fans? First, there was “A Fistful of Dollars,” followed by “For a Few Dollars More,” and then finally, “The Good, The Bad, and The Ugly.”

Indiana Jones, perhaps?

The Matrix? Although, they’re releasing a new movie as we speak, so is this a true “trilogy” anymore?

When I think about my favourite movie trilogy of all time, I don’t really need to think because it’s already etched in my brain.

The long-time TRB readers already know.

Heck, even the newer readers should know.

I have a t-shirt that says, “SAVE THE CLOCK TOWER” because I love this series so much.

My wife and I briefly considered the name “Emmett” for our son, because of the character, Doc “Emmett” Brown, in the film.

I love to joke about Delorians. And talk about getting my car up to 88 miles per hour. Not to mention, any discussion about a “flux capacitor” must have me present.

In case it’s not obvious by now, my favourite movie trilogy ever is “Back To The Future.”

I was raised on the first film in that series. We had a dubbed copy on Beta-Max that we watched religiously. We had so many parts of that movie all wrong. We thought “The Libyans” were “The Idiots,” as an example. I was 5-years-old. How the hell was I supposed to know who a Libyan was?

I know every line from that movie by heart. Part II doesn’t get much love, but I was obsessed with the notion of “the future” during my childhood, and it’s for that reason that I’m disappointed we don’t have flying cars and hoverboards in 2022, let alone 2015.

The Die Hard series is a distant runner-up, and not just because we watched the first “Die Hard” on Laser-Disc every Christmas Eve in the Fleming household in the 1990’s, but also because I love John McLaine. Who doesn’t?

It should come as no surprise that I love writing blog posts in trilogies.

Last week’s epic breakdown of the Ontario Housing Task Force’s report consisted of three parts, not quite on par with the three Austin Powers movies, but I enjoyed them more than the Iron Man trilogy because I don’t enjoy watching movies entirely comprised of C.G.I.

My beginning-of-year posts are always at least two-parts, often trilogies, as are my end-of-year themes.

Back in yesteryear, I loved to write posts and divide them into three parts, but nowadays I simply post some gargantuan 5,000-word monstrosity all at once, much to the chagrin of some of my readers who apparently have seven minutes to read TRB in the morning but not eleven.

So with that said, when a reader asked on Tuesday if I could take a look at the investment boom in Calgary, I’d be lying if I didn’t admit that I was already thinking that post was destined for a sequel. I just didn’t know where that sequel would take us.

Last month, one of my clients was emailing me pre-construction projects in Georgetown, Ontario, as we both lamented the ridiculous prices in the GTA, and he dropped this knowledge bomb on me:

And this is why a lot of us pre-con specialists in TO have skipped the last two years here and have gone balls deep in Calgary. 5% down, rental guarantees, property management and no closing costs (whereas here new pre-con closings costs are like 8% of purchase price).

I got a 3+1 townhouse with heated garage in Calgary (25 mins outside the core, but walkable to LRT, so this would be like something in Etobicoke here) for $400K all in, completes in 2024. Meanwhile a resale townhouse in Oshawa, $1.2M. I know it’s the Toronto Realty Blog but watch out here comes Canada’s sunniest city (aka Calgary).

I have to admit, I was browsing both House Sigma and BuzzBuzz Homes, looking at pre-construction prices in Calgary, and they look really cheap!

But what the heck do I know about what prices “should” be in Calgary?

In January of 2022, the average sale price in Calgary was $510,701.

If you recall Tuesday’s blog, you’ll note that the average price in The Yukon in November of 2021 was $656,800.

What sort of conclusion can we draw here?

Oh, wait, you’re not ready to draw any conclusions about prices? You’re still fixated on the comments from the Yukoners?

It’s really, really hard to pick a favourite, but I think they had me at “STAY THE FUCK OUT OF YUKON!”

There were a lot to choose from, and picking my favourite comment would be like choosing my favourite child; it’s just not fair.

But maybe I don’t blame these presumably-pleasant Yukoners. I would be very defensive about my hometown if I lived there and watched the city folk roll in.

How do residents of Prince Edward County feel after watching Torontonians invade over the past decade?

Growing up, my father and his friends owned a house in Park City, Utah, and I was fortunate enough to ski there from 1988 onwards. Despite being a well-known ski destination and former Olympic Games host, back in 1988, nobody had ever heard of Utah, let alone skied there. Park City was untouched. It was unknown. Main Street was nothing but pizza parlours and t-shirt shops. But by 2004, the last time I went there, Main Street was flogging jewelry, furs, and timeshares. I can’t fathom what it looks like today.

Many of us have our “own little slice of Heaven.”

Some might call it our “own private Idaho.”

Except for my family actually has a house in Victor, Idaho. So what would we call it?

As far as Yukon housing prices go, it seems like they’re being bought up faster than just about anywhere in the country, and whether the buyers are investors or end-users remains to be seen. I don’t take the comment from Tuesday’s blog personally, and on the contrary, it’s only heightened my interest in purchasing a property there so I can head up with my buddies to go ice-fishing, draped in Toronto Maple Leafs gear from head-to-toe.

As far as Calgary housing prices go, let’s get to it.

I want to run a quick experiment, first and foremost. It’s non-scientific, but if we go to www.buzzbuzzhome.com and simply type “Calgary,” we find 291 “new developments.”

As of 2021, the metro population of greater Calgary is 1,481,806.

Greater Toronto, on the other hand, had a 2021 population of 6,712,341, making it 4.53 times the size of Calgary.

If we multiplied the 291 developments in Calgary by 4.53, we’d expect, based on population, to find 1,318 new developments in Toronto.

However, BuzzBuzzHome shows a mere 566 new developments in Toronto at the moment!

Again, this is hardly scientific, but it shows you that despite believing Toronto to be “full of cranes in the sky,” it’s Calgary that, relatively speaking, is experiencing a real estate development boom.

Let’s take a look at resale first and foremost.

Just like Toronto, there are all kinds of different pockets of the downtown core, some higher in price than others. Then at the same time, there are buildings that are more or less popular, newer/older, and the prices can vary.

But for this experiment, I called a good friend who relocated out there for work two years ago and he’s pointed me in the right direction.

Here’s a listing for a 2-bed, 2-bath, over 1,000 square feet, in a condo built in 2015:

The price?

$549,900. Or somewhere around $540 per square foot.

That’s about half of what the same condo would cost in downtown Toronto.

Browse Realtor.ca and you’ll find lower-cost options, but as with Toronto, anything that looks too good to be true, probably is.

So what’s all this talk about “investment opportunities” in Calgary then?

Well, as my client alluded to above, the market works differently out there than in Toronto.

First and foremost, only a 5% deposit is required with many of these developments. In Toronto, it’s usually a minimum of 15%, but 20% is most common, and some developments want 25% in total over the course of a year or more. Being able to purchase with a mere 5% down means that the investor can either commit less capital to the investment or, potentially buy four properties with the same investment that he or she would commit to a Toronto investment.

Secondly, as my client noted, the closing costs in Toronto can be upwards of 8% of the purchase price. Whether that’s levies and fees from the developer (much of which goes to the municipality and province) or whether that’s land transfer tax, it’s pricey to close on a Toronto pre-con! In Calgary, if we’re talking low closing costs from the builder combined with non-existent land transfer tax (they have a “property registration fee” that is a few hundred dollars), then you can see where the savings exist right off the bat.

So, do you want to see a current example?

A project called “Skyview North” was launched this week, and here is their price list:

$299,900 is a price point I haven’t seen in Toronto since about 2010.

And at 664 square feet, that’s a paltry $451 per square foot.

Not only that, how about this little ditty:

One parking spot included with every unit.

I’ll bet you didn’t see that coming!

In Toronto, investors, er, buyers, can only purchase parking spaces if the unit meets a certain size or price threshold, usually a 2-bed, 2-bath, for example. And parking spaces are running about $70,000 on average, by my estimation.

In Calgary, a parking space is essentially free.

In this particular project, they want a 5% deposit upon signing and 5% in 90 days. That’s it. That’s 10% in total until closing in 2025.

Here’s the floor plan:

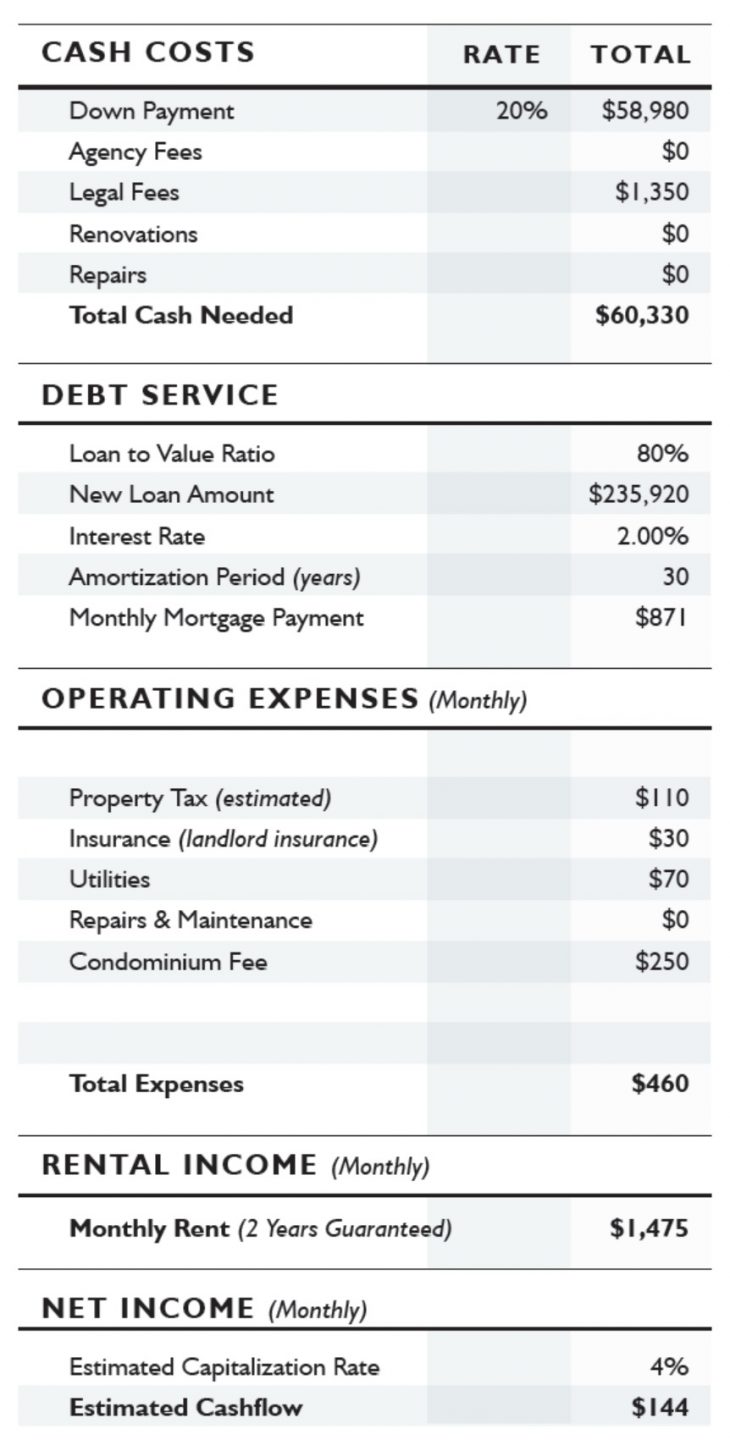

So what does the return on investment look like, you ask?

Well, I’ll be honest: I’m not going to break it down for you.

But that’s only because it’s already been done for me!

The developer sends out a detailed financial analysis with their launches, which is something we don’t see here in Toronto (or if we do, it’s complete bullshit).

Check this out:

Feel free to poke holes in the numbers above, if you’d like.

But there’s no land transfer tax out there.

Rents are guaranteed for the first two years.

“Repairs and maintenance” will likely be more than $0, but I guess that depends on what type of landlord you want to be.

Of course, they are basing their $144/month positive cash flow on a 20% down payment, and I noted that you can buy into this project with 10% down, but remember that the CMHC mandates a 20% down payment for all investment properties, so those 5% or 10% deposits are merely the monies paid to get your foot in the door. You have to finance the condo once you actually own it.

Now, the financial analysis is really driven home with this:

A 186.8% return on your initial investment, inside of five years.

Call this a fabrication if you want, or poke more holes. Be my guest!

But this is what’s driving the real estate boom out in Calgary, or the “investment frenzy” as blog reader JF007 commented on Tuesday.

Now, would you like to hear my client’s take on all of this?

She or he was all geared up…

The Case For Calgary (Go West, Young Man!)

I’ve bought 6 properties in Calgary (5 condos and 1 townhouse) for a total present value of $2.2M, on only $130K down (not a typo). The properties will be delivered in 2023 to 2025.

Calgary prices need to rise by at least 60% in a few years in order to maintain the Calgary-GTA price gap. Otherwise, prices in the GTA will be 4x that of Calgary, which is impossible, long term.

Back to the math: 60% increase by 2028 (likely sooner), portfolio is now worth $3.52M ($1.32M gain) off my $130K investment. Voila, 10 bagger!

Bonus: not only has my net worth increased by $1.3M, but I keep all the properties long term as they pay for themselves and I get an annual mortgage principal pay down of $60K a year which is basically the average salary in Toronto.

Factor in a modest 3% appreciation over the years (let’s face it, it’ll be higher!) and the number becomes so big I’ve lost count.

If I am wrong (I won’t be), who cares? I am controlling an 8-figure portfolio here in Toronto. This is as asymmetric a bet one will ever find in real estate.

One more thing: did you know there was once a time when the average price in Calgary was higher than Toronto? That was 2006. Oil was $100/barrel then. It will be $100/barrel this year. I’m not sayig that Calgary is going to overtake TO any time soon (or ever for that matter) but there is no way this city can remain this cheap for long. Yeehaw!

Well, there you have it, folks!

Calgary is exploding! And it’s being driven by that all-too-familiar culprit: investment dollars.

Shall we start the bubble talk, or is that premature?

Speaking of premature, blog reader Derek and I shouldn’t have chartered that plane to Whitehorse just yet. Don’t get me wrong, it isn’t because we’ve decided not to go, but rather, we had booked a 40-seater and now I think we’ll need 200+…

Have a great weekend, folks!

hoob

at 8:21 am

I still can’t get over the daft “prairie modern” ugliness of new in-built mcmansions in the suburbs. It’s just so… horrid.. (Mind you the suburbs in Toronto are similarly horrid, but for different aesthetic reasons.)

Republican

at 3:53 am

Toronto is a shit hole

Mxyzptlk

at 9:31 am

Thank you for that erudite analysis, Plato.

Jag Mohindra

at 10:07 pm

I am interested in sky view North Condo project

Please guide how proceed.

Milli

at 10:34 pm

Agreed ????????

Jared

at 8:34 pm

Lol that sucker who bought 5 condos.

That’s the one area of real estate that hasn’t been profitable since the oil boom.

But please, go ahead Ontarions. Please buy up those condos. They’re so “cheap” and you will definitely get a return and have no problem selling

Ashleigh

at 9:39 am

Was going to say this. They’re so certain the condos will be worth 60k more in 5 years? Condo values have only gone down or static. They do not inflate here.

JF007

at 9:45 am

thanks David for indulging my request…really intriguing numbers worthy of giving some serious thought to invest.

RPG

at 10:38 am

Can’t help but notice the Calgarians are a little quieter and less territorial than the Yukoners. Just saying.

Seller in waiting

at 12:04 pm

Give it some time… It’s only 10am in Calgary right now however I don’t expect the outrage we got on Tuesday to repeat.

Hopefully next week we can get back to the regular scheduled program of Appraiser and Chris going at it. Where is Chris anyway? Oh ya the stock market is down so I guess so is Chris…..

Appraiser

at 9:05 am

I must be going soft…I kinda miss Chris lately.

Bal

at 12:16 pm

Calgary is used too…Many investors from GTA and Vancouver already in Calgary….

Republican

at 3:55 am

Hopefully they flood those homes renters can be a testy lot I hear there is a movement to destroy Ontario people’s rentals in Alberta. .something about tearing down rental tyrants just like you .

Dennis

at 3:29 pm

Interested, where can I find the builder info and what the area is like etc.

MWB

at 10:05 am

Get on a plane. Tickets are like $100.

Jeremy

at 3:48 pm

Lots of interesting assumptions in that argument but this one sticks out “Otherwise, prices in the GTA will be 4x that of Calgary, which is impossible, long term.”

I’m curious about the rationale there. Does the same logic apply to Thunder Bay? Waterloo? Victoria? Montreal? Presumably the expectation is that eventually people can’t afford to live in Toronto or choose to move for financial reasons but New York City is still full of people…

Libertarian

at 9:45 am

I had the same thought. Strange assumption.

I chalked it up to be simple real estate investor logic – all prices must go up, even in Calgary.

Just because you deem something to be undervalued relative to something else doesn’t mean that it will increase in value.

But it’s working for him, so that’s all that matters. He’s an early investor, so he’ll benefit from all the investors who follow and increase demand, raise prices, etc. Then Calgarians will complain about unaffordable home prices and the investors will deny that it’s their fault.

Don

at 8:14 pm

Well, look at Hamilton vs Toronto. Pre pandemic, say 5-7 years ago, back when detached in Toronto was $1.2ish million, you could get a similar home in Hamilton for $400K. Prices of such homes in Hamilton have doubled (or more). Prices in Calgary are too cheap. But that’s after a decade of stagnation, so eventually even Calgary prices have to increase.

London Agent

at 8:08 am

Lord of the Rings is spectacular (the directors cut is a must and could probably be 2-3 hours longer imho), I’m curious to know why you don’t support the fantasy genre as a whole David!

Those numbers are intriguing however I’m reminded of a blog post from a few years ago comparing renting to owning, and it was concluded that renting a home in Calgary (and investing surplus money) was a superior way to build wealth than owning a home.

I would be curious to hear similar accounts from local Calgarians(?) as to the state of their housing market and lack of supply.

Condodweller

at 10:52 pm

Does this mean the Calgary market has bottomed? I did look at Calgary a few years ago and found values were still heading down. Preconstruction units that were about completed were way too expensive. Houses were good value if you were looking to live there and you could rent a house for not much more vs condos.

Recently I have seen social media posts by people trying to sell their condo, unsuccessfully, and trying to figure out if it was better to sell at a loss and stop the bleeding or rent it out as they couldn’t afford to keep it after job losses. I recall negative comments about some of the property management companies and having to be extremely careful what building to chose if you are going to do it.

I don’t know how these guaranteed rental incomes are structured but something tells me the two are related i.e. property managers not maintaining buildings properly or high maintenance fees to compensate.

Even with the guarantees, what about after they expire and you can only get half of it in rent. I imagine the oil sector would have to recover first before property prices/rents meaningfully increase.

Also, if David’s friend has sufficient equity in the GTA and sufficient income to borrow on these properties that’s great but what about the “average” person? They still need to have salary/business income to qualify for the mortgages. That’s another challenge, will banks in Calgary lend on a local property to someone living in Ontario? Or would a bank in Ontario lend on a property in Calgary?

Soelas

at 1:42 pm

Agree Condos are a bad place in Calgary right now. Just echoing your comments and can confirm from my personal experience and stories from friends. For clarity – Calgary’s economy is/was heavily weighted to downtown activity. Logically, RE prices in the downtown core were comparably high. The pandemic killed downtown activity and related prices- why would anyone want to live downtown if nothing was happening (work or entertainment)? Additionally there is a LOT of new inventory with more coming online and no real signs of slowing. Right now I’d say prices and rents are probably 75-80% what they were bs 2017 in the downtown core (that’s based on numbers I know from people I trust. Looking at proper data may tell a different story). Property Management is a joke here. Finding good PMs is typically tough, but much worse right now. Most of what I’ve seen and heard is that PMs are basically phoning it in every chance they can because “COVID”. Additionally, they seem to be passing costs on to whoever they can vs trying to manage them (maybe it’s just me but most of my network that own condos have shared stories about getting abnormal fines for petty things and special assessments in 2021). Outside of downtown is a much rosier picture. However, for those who want to take big risks you can get condos cheap (not new ones) and if/when downtown core activity/prices return you’ll probably do well both in selling and renting.

Patel

at 8:12 am

I have booked town house with builder name home by Avi in Calgary northwest builder cancelled the project by saying they didn’t have permission to build..I don’t believe them because market getting hotter after some time they will start project and make more money…rich people getting rich they manipulate middle class

Chris

at 10:01 pm

David. You heard us Yukoners express the severity of our homelessness and housing crisis (amplified by recent increases in out of Territory buyers snapping overbidding is out), and you still have the heart to say that this only makes you want to buy property here even more. Wow. You truly are very insensitive. And you wonder why we don’t like when people with that way of thinking come into our territory.

Condodweller

at 12:31 am

Look David you have a new fan. @Chris you you’re going to have to start using the name Yukon Chris as Chris is already taken.

David Fleming

at 1:26 pm

@ Chris

It was a joke. I tell a lot of them here on TRB…

Republican

at 3:53 am

Fuck you . Stay in Ontario you shit hole dweller importers.

Allison W.

at 4:30 pm

Dave:

I am long time reader and this is my first post.

I never felt the need until now.

I have read that you do not delete comments unless they are about your family or are racist or vulgar.

I appreciate your desire for authenticity.

But comments like these diminish the quality of your website.

They provide no value add and I do not believe that other readers would mind if these comments were removed.

Allison W.

Steve

at 9:56 pm

Then we’d miss out on being your neighbor, I guess? You seem like a real peach.

Unknown

at 11:23 am

What a struggle to read. Took too long to get to the point and had lost interest after the second paragraph. I am very interested in the boom Calgary is experiencing however I felt like I’d stumbled across the wrong article when there was still not mention of Calgary and just movies for paragraphs on end.

David Fleming

at 1:29 pm

@ Unknown

I rarely “get in the mud” in the comments section but I’m in my car waiting for a client, so what the heck!

You lament that there’s “no mention of Calgary” except you also said you didn’t get past the second paragraph. 90% of this blog is about Calgary, including all the photos of properties, financial analysis of investments, et al.

I’m sorry that you “struggle to read.”

Man, I’m so tired of people. People are the worst.

So I basically have to contend with a slew of Yukoners posting under pseudonyms on TRB for the next few weeks, until they lose interest.

(sigh)

Sirgruper

at 6:37 pm

Guess he’s never heard of skimming.

David. Stay positive. The silent majority has your back.

PS. That’s for the pick 5 shoutout.

Landlord84

at 7:20 am

???? .. Wish there was a way to like and dislike comments.

Long time reader from Vaughan btw.

In-laws from Calgary. We’ll see how Russian affects the oil market.

Mxyzptlk

at 5:57 pm

Hey, Unknown:

Just take a bit of time and effort (apparently not your strength) to find blogs/articles you like rather than bitching about blogs you assume after ten seconds that you don’t/won’t like. There are millions of alternatives to stuff you don’t like. In other words, just shut up and slink off into the night.

JD

at 10:15 pm

I’ve lived in Calgary for 35 years and have seen various booms and busts. Sure, oil is currently at $100 but it was only last year that everything was doom and gloom here with people leaving the city for better jobs and talk of Calgary being the next Detroit. I would be cautious leveraging myself on this little boom we are having. I do hope it continues as we own our house, but I’m skeptical it will continue long term. Calgary has a lot of potential to keep building outwards and still not be too far away from downtown which is, what I think, the main difference between here and Vancouver where you are unable to do that.

Anyhow, I really do hope there are investors out of town looking to buy. I might start researching some local realtors to see if I can sell my house to an investor and sign a 1-2 year rental agreement to continue renting my house from them until we decide what our next house will be.

Nick M.

at 12:52 am

I grew up in the GTA, and have lived in Alberta for the last 10 years.

The market doesn’t work the same as it would in the GTA or Vancouver. In that supply can easily keep up with demand. Even if demand goes in hyper drive.

First the city is a river city, unlike a lake side or Ocean front city, it can expand in ALL directions. So there is a lot less risk in scarcity of land.

The city and greater surrounding area is still under 2 million. So it still has a lot of room to grow.

In Alberta, it is much easier to build, and there a lot more small companies building. I have seen many Condos start construction, only to go bankrupt, halt construction, only to be completed 2 years later by a new owner.

A small spike in house prices, will be accompanied quickly by higher activity in new homes built.

I can speak about condos in Edmonton, Canada’s 5th largest city, and that is Condos aren’t liquid out here at all. Selling can be a pain.

The primary reason why house prices are going up, is that house prices are indexed to the cost to build a new home.

The cost of materials to make a new homes have gone up. Lumber prices have tripled, and there is a shortage of vinyl siding, which is temporarily slowing supply from being completed.

Calgary has a lot of wealth per capita. Hence, a lot of Calgarians own investment properties. So you won’t be entering an immature market, but the city will be larger than Montreal in 20 years.

K80

at 11:38 pm

The main thing with condos in Calgary is that the market is absolutely saturated with them. They take forever (we’re talking multiple months) to sell and most people are lucky to break even on their original purchase price.

If you’re okay with holding a Calgary condo for years and years, then maybe it’s worth it for you. But if you think you might try to sell it within ~5 years or less, I just wouldn’t bother.

Gerry

at 9:25 pm

If I move anywhere its south. The closer to US the better. Why anyone would move farther north is beyond me. By far…Southern Ontario is the most desirable location to live in this sparsley populated nation.

Jag Mohindra

at 10:10 pm

I am interested in purchasing a condo in Skybiew Project North. Please guide.

Thanks

Jag

Alya

at 1:49 pm

Nonononono. In the most polite way possible, people are coming to Calgary and it’s driving up our already whack housing/rental prices. Please don’t pull up right now ????????

Brian Viens

at 10:08 pm

As a long time Calgarian and Canadian, we welcome all to the best city in Canada!! But please please please leave your Ontario way of living there!!!!!!! We have a better lifestyle out here and almost NO TAXES, this is done by having little government and lower social programs. We have done very well keeping this the norm, so common out and see how big the sky really is!! And with the best stampede this year alone we will show how the west will win your heart.

Cheers, from a former Ontarian and proud reformed Albertan

Jen

at 9:29 pm

You are so right!!! I currently live in Ontario and wish I had never left Alberta, as it is a MUCH better quality of life. Calgary is such a friendly, vibrant city and a great place to live.