The Impact of Inflation on Mortgage Rates

Keeping Current Matters

MAY 10, 2023

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve.

Keeping Current Matters

MAY 10, 2023

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve.

Housing Wire

MAY 10, 2023

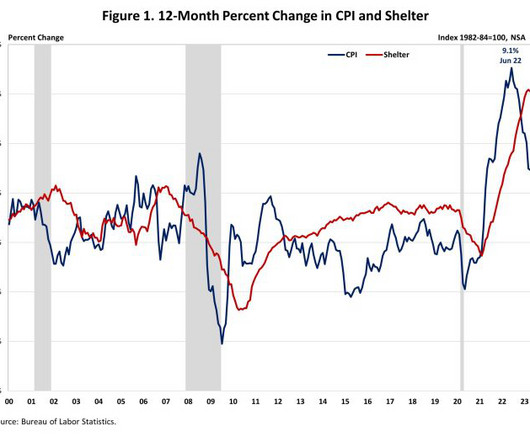

The massive inflation and double-digit mortgage rates of the 1970s and early 1980s seem to haunt the Federal Reserve , which wants to cool the economy and even provoke a job-loss recession to avoid that scenario. But the latest Consumer Price Index inflation report shows how the fear of 1970s-style inflation is wildly overblown. Today’s numbers don’t look like the 1970s at all, when rent, wages, and oil shocks sent inflation running hotter than anything we have seen in recent modern-day hi

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Real Estate News

MAY 10, 2023

The fees, which were scheduled to go into effect on Aug. 1, were opposed by industry groups including NAR and the Mortgage Bankers Association.

Housing Wire

MAY 10, 2023

Dallas, Texas-based Mr. Cooper Group has entered into an agreement to acquire struggling Home Point Capital for $324 million in cash, the companies announced on Wednesday. The transaction will ultimately result in the seller shutting down operations. Rumors that Mr. Cooper was interested in Ann Arbor, Michigan-based Home Point spread prior to the latter selling its wholesale origination business to The Loan Store on April 7 and were amplified after.

Advertisement

Ready to better your Back Office? Dive into the secrets to a powerhouse back office with Brokermint expert, Jessica Souza. In this free download, she shares her 3 transformative hacks designed to clean house, get everyone on the same page, and set yourself up for success. From optimizing agent profiles to ensuring flawless transactions and boosting agent retention, these strategies are your ticket to a seamless operation.

Real Estate News

MAY 10, 2023

Brokerage leaders expect agents to be more tech-savvy than ever before, bringing new skills that enhance traditional approaches to buying and selling homes.

Housing Wire

MAY 10, 2023

Payroll connectivity platform Argyle announced this week that it has grown the number of its consumer verifications 100% year over year and has welcomed over 35 new customers so far in 2023. The company offers direct-source data portability tools for mortgage, lending, banking, background and tenant screening, and other use cases. “We’ve packaged five years of learning and innovation into our next-gen platform to continue automating critical workflows, reducing business risk, and pro

Residential Realty Today brings together the best content for real estate professionals from the widest variety of industry thought leaders.

Housing Wire

MAY 10, 2023

UWM Holdings Corporation , the parent of United Wholesale Mortgage (UWM), reported a financial loss in the first quarter amid a decline in the fair value of mortgage servicing rights ( MSRs ) and falling origination volumes. The wholesale lender posted financial losses in the first quarter, but the company increased margins as it pulled back on its aggressive pricing strategy.

Inman

MAY 10, 2023

Agents should be prepared to answer their buyer's mortgage questions, including types of mortgages, lender guidelines, preapproval vs. prequalification and the closing process in the area.

Housing Wire

MAY 10, 2023

The expectation that the Federal Reserve might be done with hiking rates spurred the mortgage market last week. “Mortgage applications responded positively to a drop in rates last week, as the Fed signaled a potential pause at the current level for the federal funds rate in anticipation of inflation slowing and tightening financial conditions that will slow economic and job growth,” Joel Kan, Mortgage Bankers Association (MBA) vice president and deputy chief economist, said in a statement.

Inman

MAY 10, 2023

At NAR's midyear conference, Senior Counsel Chloe Hecht offered best practices to help navigate artificial intelligence without running afoul of copyright law or the Realtor Code of Ethics.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Housing Wire

MAY 10, 2023

April’s Consumer Price Index data is welcome news to the Federal Reserve , which is debating whether to continue hiking interest rates after its most recent 25 basis point hike last week. Especially encouraging is that housing inflation pressure in the CPI is starting to ease, with April representing the smallest one month change in over two years. Overall, consumer prices cooled further in April, with the CPI rising 4.9% year over year, before seasonal adjustment, according to data released Wed

Inman

MAY 10, 2023

A "drought" of new listings is driving up prices, reversing the sluggishness of late 2022 and forcing buyers to compete fiercely for homes, according to a new analysis from Zillow.

Housing Wire

MAY 10, 2023

Real estate valuation technology company Clear Capital announced on Wednesday that it has expanded its partnership with ValueLink , a valuation management platform, to offer better support for appraisal modernization policy changes. Through this expansion, ValueLink customers can now access Clear Capital’s proprietary Universal Data Collection (UDC) solution, which offers fast and accurate data collection and submission that meets Freddie Mac and Fannie Mae data standards for property data repor

Inman

MAY 10, 2023

Overspending is a significant challenge that almost every real estate agent has to face. However, with the right strategies and practices in place, you can rein in your spending and significantly grow your profits.

Advertisement

Navigated 360° tours, like YourVRTours, advance pipelines by engaging clients further along the sales funnel. These immersive experiences provide comprehensive property insights, increasing buyer intent and readiness. By embracing navigated tours, agents can optimize property exposure, better qualify leads, and streamline the sales process. Stay ahead in the ever-evolving real estate landscape with innovative technology that elevates buyer journeys and progresses pipelines more effectively.

Housing Wire

MAY 10, 2023

Real estate giant Anywhere is launching a title insurance joint venture exclusively for Anywhere Brands franchisees, according to an announcement on Wednesday. Upward Title & Closing is a full-service title and settlement company. The joint venture capitalizes on Upward’s local housing expertise, as well as Anywhere’s technology, including virtual quote tools and options for a fully digital closing.

Inman

MAY 10, 2023

Preparing your first real estate agent business plan takes time, effort and research. Thankfully, it doesn’t have to be long or complicated, just specific enough to outline what you want to accomplish. A well-prepared business plan will help you set a clear direction, stay focused and increase your chances of success.

Housing Wire

MAY 10, 2023

Introducing Inside Voices with Kristin Messerli, a new interview video series hosting by Messerli, who’s research on NextGen homebuyers helps to inform tomorrow’s generation. She is also author of NextGen Homebuyer Research and a speaker and educator. Today, she interviews Lili Thompson, founder of Lili Invests. At just 27 years old, she has already established ownership of 13 properties.

Inman

MAY 10, 2023

All items index increased 4.9 percent for the 12 months ending April, the smallest 12-month increase since the period ending April 2021, according to the Consumer Price Index Summary.

Speaker: Sarah Santa Ana, Real Estate Coach, Move4Free Realty

Networking is one of the crucial elements in every real estate organization's success. Both agents and real estate companies need to maintain robust networking links. This is why social media is essential for any real estate professional! Social media enables you to stay in touch with your present clients, maintain connections with your past clients, and engage potential customers and investors.

Housing Wire

MAY 10, 2023

Blend Blend’s end-to-end mortgage suite delivers a world class experience for both borrowers and Loan Officers while delivering powerful operational efficiency with automation and data driven workflows. Product Fast Facts #1 Conditions Sync automatically translates underwriting conditions to actionable guided borrower facing followup #2 Lenders can define specific logic and rules around which conditions should be synced between Blend and Encompass #3 65% of conditions are identified upfront with

Inman

MAY 10, 2023

Applications for purchase mortgages rose 5 percent last week, but a strong jobs report and ongoing bank instability are pushing mortgage rates back up.

Housing Wire

MAY 10, 2023

Total eClose With more borrowers using mobile devices to participate in the mortgage process, we’re offering an intuitive tablet-based experience. Why limit borrowers to eClosing only when they have access to a desktop or laptop computer? By offering the flexibility to eClose using any device, Total eClose makes the eClosing process, including Remote Online Notarization (RON), even simpler.

Inman

MAY 10, 2023

UWM CEO Mat Ishbia highlights "operational profitability" as a $337 million write-down in fair value of mortgage servicing rights drives a $138.6 million first-quarter loss.

Speaker: Trey Willard, Realtor/Team Leader at Keller Williams Realty, Inc.

In order to create continued success in today’s real estate market, realtors need to utilize an arsenal of technology that will increase their efficiency and presence on social media. Using technology to manage your prospects and tap into their needs through websites, social media, and other channels is critical for real estate success in 2022 and beyond.

Housing Wire

MAY 10, 2023

AutomatIQ Borrower Income Analysis AutomatIQ Borrower Income Analysis is an all-inclusive intelligent calculation and analysis tool that leverages state-of-the-art CoreLogic technology. The tool allows lenders to qualify borrowers faster by examining all income sources automatically and reliably. In addition, the solution enables the underwriter, processor and loan officer to generate an easy-to-read report that helps you meet unique investor’ and GSE requirements, saving time and enhancing cust

Inman

MAY 10, 2023

Despite economic turmoil, investors large and small are still a force to be reckoned with in the housing market. Intel broke down the cities they've soured on — and the ones they just can't quit.

Housing Wire

MAY 10, 2023

Solex ® IPEN Solex IPEN gives Settlement Agents the convenience of a seamless signing experience with the efficiency and accuracy of a digital closing. Enjoy enhanced functionality within Solex, including a custom QR code sign-on experience and the ability to sign on any device, anywhere. IPEN sessions have never been easier – let Docutech’s Solex be your solution.

Inman

MAY 10, 2023

The dominant iBuyer has taken extraordinary steps to survive this period of upheaval, writes real estate analyst Mike DelPrete, who dug deeper into last week's Q1 earnings exclusively for Intel.

Advertisement

Curious as to how you could do 18% more business? How about 14 more transaction sides per year? Check out this infographic with data from a RealTrends study to learn more.

Eye on Housing

MAY 10, 2023

Consumer prices in April saw the smallest year-over-year gain since April 2021. This marked the tenth consecutive month of deceleration and the first time the rate has fallen below 5% in two years. While the shelter index (housing inflation) experienced its smallest monthly gain since January 2022, it continued to be the largest contributor to the total increase, accounting for.

Inman

MAY 10, 2023

Lending industry groups like the Mortgage Bankers Association called a fee based on borrower's debt-to-income ratio "unworkable.

Eye on Housing

MAY 10, 2023

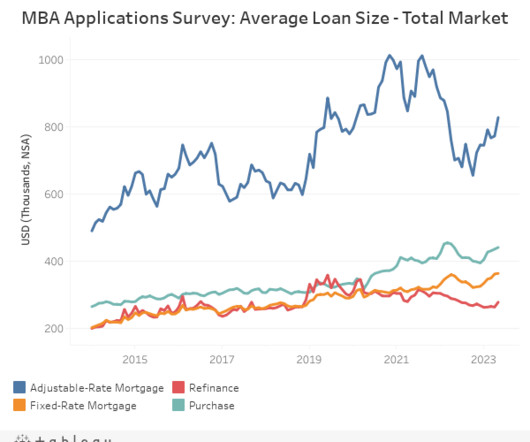

Per the Mortgage Bankers Association’s (MBA) survey through the week ending May 5th, total mortgage activity increased 6.3% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate fell two basis points to 6.48%. The FRM rate has risen 18 basis points over the past month. The Market Composite Index, a measure of mortgage loan application volume, rose.

Inman

MAY 10, 2023

Are homebuyers asking for concessions? Are bidding wars ubiquitous in your market? Answer a few simple questions to determine if your area favors homebuyers or sellers this spring.

Speaker: Mary Maloney, Founder & Team Leader at Hometown Realty

The sales cycle in real estate is frequently measured at 3+ months. During this time, real estate agents frequently lose contact with clients and miss out on opportunities because they fail to follow up and provide value to the client. Top real estate agents are distinguished from developing agents by their ability to convert organic connections into sales opportunities.

Let's personalize your content