July 30th, 2021. Wow, that seems like so long ago!

The temperature was in the 30’s, so many people were vacationing or unwinding at cottages, and there wasn’t the faintest thought of snow.

Fast-forward to today, and we’ve all put the snow brushes in our trunks, and apparently, there’s a Christmas tree shortage across the GTA?

My, my, how times have changed.

But do you want to know what hasn’t changed since July 30th? Blaming rising real estate prices on people rather than market forces.

July 30th, 2021, I wrote: “The Friday Rant: We’ve Run Out Of People To Blame”

This was in response to a juicy Toronto Star hate-piece on real estate agents entitled, “Realtors Are Making Big Money Flipping Houses. But Should They?”

But if you recall my blog post, I didn’t take issue with the fact that the Toronto Star seems to believe that Realtors shouldn’t be allowed to invest in real estate, but rather that they’re seeking to blame Realtors, at least in part, for increasing the price of real estate, instead of investigating actual causes.

Actual causes.

It sounds like “fake news,” right?

But I’ve been talking about this for so long that I must sound like a broken record: there’s more to rising prices in a market than an identifiable culprit.

Life would be easier with somebody to blame for each and every one of our problems. That “lone gunman” conclusion lets us sleep much better at night, and when it comes to skyrocketing Canadian real estate prices, onlookers are essentially presented with two conclusions to pick from:

1) Market dynamics, ie. the interaction between buyers and sellers, in a market with varying levels of supply and demand, combine to determine price.

2) A person, people, or a group, namely investors, flippers, speculators, realtors, foreign buyers, REITS, rich people, developers, politicians et al are responsible for the current price levels in our real estate market.

Which conclusion is easier to accept?

If you’re somebody who is not in the market, and thus not on the so-called “property ladder,” ignorance is bliss. There are many in that group who know that without a hand on that ladder, they run the risk of never owning in Toronto. And those of us who were the beneficiaries of simply being born at the right time will remain thankful, but not concede that the market “has to tank” or that there is somebody to “blame.”

That’s what Toronto real estate has become in 2021.

Blame.

And shame. Lots of shame.

Here’s a headline from BlogTO today:

“Rich parents,” eh?

Add them to the list of people to blame?

BlogTO is a little late to this party, since the other media outlets reported on Benjamin Tal’s CIBC report in articles posted a month ago. The only difference, other than being timely, is that BlogTO editorialized the headline by referring to “rich parents” when the other media outlets did not.

BNN Bloomberg wrote, “Parents Gifting $82,000 On Average To First-Time Homebuyers: CIBC”

The Globe & Mail wrote, “Parents Gave Their Adult Kids More Than $10 Billion To Buy Houses In The Past Year”

Even the left-leaning Toronto Star merely headlined, “Parents Are Gifting Increasingly Large Sums Of Money For Kids’ Down Payments”

Add BlogTO to the list of media outlets selling blame and shame.

Blame & Shame

Sounds like a WWF tag-team from the late 1980’s: Blame & Shame.

Sounds like a rap rival to Kriss Kross, circa 1991: Blame & Shame.

Sounds like a documentary on steroid-era baseball players, Sammy Sosa & Mark McGwire: Blame & Shame.

It sounds like every response to rising real estate prices in our country, specifically in Toronto. And this week, we were given a new segment of individuals to blame: investors.

Investors! Of course!

I feel like Emmett “Doc” Brown, when Marty McFly tells him, back in 1955, that it takes 1.21 gigawatts of electricity to get the flux capacitor working.

“Of course!”

It simply has to be investors! Why else could real estate prices be rising?

It can’t be because there’s too little supply in our major cities.

It can’t be because new construction is stagnant.

It can’t be because the municipalities are thwarting and disincentivizing development.

It can’t be because provinces aren’t forward-thinking enough to expand infrastructure.

It has to be a person or a group of people, and today, we have investors to blame.

The Bank of Canada has come out and blamed investors directly for the run-up in housing prices, but is also pre-blaming investors for a possible correction, which they talk about every year.

BNN Bloomberg: “Bank Of Canada Says Investor Rush Into Housing Risks Correction”

Financial Post: “Investor-Fueled Housing Mania Puts Central Canada’s Biggest Cities At Risk Of Correction: Bank Of Canada”

From the latter:

Ground zero of the national housing crunch has shifted to Central Canada’s biggest cities, and excess demand appears to be coming from investors, not households, according to the Bank of Canada’s bi-annual review of the financial system.

The housing mania that has gripped the country for more than a decade originated in Vancouver, where the combination of ultra-low interest rates, international money and low supply combined to ignite a real-estate boom that captured global attention, and eventually morphed into an affordability crisis that turned housing into an important political issue.

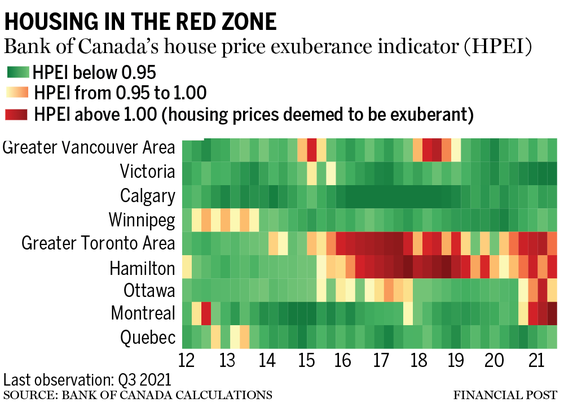

The Financial Post article also gives us a beautiful chart with an “exuberance indicator” as follows:

You know what I think of these “indicators,” right?

I mean, Toronto was in the “red zone” in 2016 but housing prices are up from an average of $729,824 in 2016 to over $1.1M today.

The UBS Bubble Index has hammered Toronto for a decade, and allowed me to write this blog post last month:

“The Gift That Keeps On Giving: UBS Bubble Index 2021”

Are prices in Toronto exuberant? Yes. Are they going to decline? No.

But these are two different topics, and the Financial Post article seemed to combine them into one. If we can go back to blaming groups of people for the continued increase in housing prices, there’s another article that I want to look at:

“Investors Now Make Up More Than 25% Of Ontario Homebuyers, Pushing Prices Higher, Experts Warn”

In the story, a would-be home-buyer is profiled. She and her family have been saving and attempting to purchase a home in Toronto, but prices are rising too fast!

“Whenever we get money — enough for buying a house — the price jumps again …and then jumps again,”

I can come off as a jerk on a regular basis, I know that. It’s usually to drive home a point, however.

Do I have feelings? Sure! I feel for this woman and her family.

But I’m also a cynic and a realist. I know that a media story isn’t a real story unless you have a face and a name, and in this case, a victim of the market, posing for a photo. As the story continues, you’ll find a second victim of market forces as well.

It’s a sad story and I’m sure there are tens of thousands of others that could have been profiled.

But what can we do?

Do we tear down the city, start over, and build three million houses all the same size and price?

The ever sadder truth is: not everybody is meant to own a house in Toronto. I continue to emphasize this, over and over, with the risk of being reprisal from a society that is increasingly coddled by a government that promises the world.

I know nothing of those profiled in the CBC article, but I do know that not everybody can own. It’s just not possible. And what they can own, and where are other stories altogether.

It’s fair to say that, with respect to the person quoted above, that perhaps she and her family could have bought what they could afford and where, at the onset. But as she explained, every time they were ready to buy, prices were higher.

This is called “a market.” Prices move up and down, and in this market, prices continue to move up. So if a potential buyer identifies a particular house/size/style/location and looks at the price, decides that’s what they want, and then saves to buy that house and that price, they risk being left behind in an increasing market.

Of course, the CBC has blamed investors. But that’s only because the Bank of Canada seemed to blame them first, and so followed articles from the Financial Post, Globe & Mail, BNN Bloomberg, and I’m just waiting for whatever the Toronto Star puts out.

While the tone of today’s rant risks coming off as insensitive, especially in response to actual people being profiled in the CBC article, it’s not them that I have problem with, nor the media for reporting what the Bank of Canada said this week. I have a problem with this idea that we need somebody to blame.

Can those individuals in the CBC story really not afford a house because of investors?

They can’t afford a house for a variety of reasons, not limited to the fact that they seemed to be timing the market, they may have set their sights too high in the first place, there’s low inventory, high demand, interest rates are low, housing completions are down, the municipalities aren’t fast-tracking construction, and a host of other factors which probably are more impactful on the supply side rather than the demand side.

“Of course!” shouts Emmett “Doc” Brown.

Supply!

Every time we look to “blame” a person, people, or a group, we focus on demand.

For a time, it was foreign buyers. They were nameless, faceless, and easy to blame. Who can’t get behind this, right? Blame foreign buyers! Their bottomless pockets, their dollar that makes the Loonie look like Monopoly money, and their obsession with real estate! Some time around 2015, all this talk of foreign buyers driving up prices in our market began, and then came talk of taxing our way out of this problem, which eventually led to taxes that have brought in little revenue and had no impact on the market.

We’ve blamed developers at times. They’re evil. They’re awful. They cancel projects and try to sell them for more money.

We’ve blamed speculators, flippers, real estate agents.

There’s no shortage of people to blame!

But investors? Really?

Are we at the point where investors should be banned from buying real estate altogether?

September 12th, 2018, I wrote: “Should Housing Be Commoditized In Canada?”

Should we revise this conversation?

It’s an old topic, but seemingly becoming more relevant.

Recall this article from way back in 2017: “Housing Is A Human Right, Not A Commodity”

Here’s a great excerpt:

Housing is now predominantly valued as a commodity, traded and sold on markets, promoted and invested in as a secure place to park unprecedented amounts of excess capital. The view of housing as a human dwelling, a place to raise families and thrive within a community, has largely been eroded. Despite its firm place in international human rights law, housing has lost its currency as a human right.

This is right and wrong at the same time, since it ignores the type and location of housing.

But can we have it both ways?

Can housing be a fundamental right, but also be commoditized?

If we’re going to continue to look for people or groups to be blamed for the increase in housing prices, but at the same time, demand commoditization, then we’re not going anywhere productive.

Consider how much demand there is for fractional ownership right now.

Recall our discussion about Key Living from this past summer.

July 26th,2021: “What Is On Demand Home Ownership?”

July 29th, 2021: “Interview With Mark McLean From Key Living”

Key Living allows individuals to get into the market and “own” part of a condo without having the full 5% down payment or money for land transfer tax.

But if you really want to “invest” in real estate without owning, there are other options, and these options take the idea of “commoditization” to another level…

Recall this blog post from July:

“What In The World Is Fractional Ownership?”

Companies like Addy and BuyProperly allow you to purchase shares in a condo. Shares. So it’s one thing to talk about whether “investors” who buy condos in downtown Toronto, townhouses in Ajax, or vacation properties in Collingwood, are responsible for the massive surge in housing prices, but it’s another thing altogether to talk about commoditizing houses and condos to the point of being able to invest $100 with the click of a button.

So which path forward, then?

Because on the one hand, we have the Bank of Canada stepping up to the microphone and blaming investors for driving up housing prices, and on the other hand, we have a population here in Canada with an insatiable appetite for real estate investing at any level and through any means.

Do we blame the people or do we blame the system in which they work?

Or do we finally look at the other side of the coin and blame supply?

For far too long, the government has sought to “fix” the housing market by implementing demand-side measures for which they didn’t have to reach very far. It was easy. It was the lowest of the low-hanging fruit, but they’re reaching for the wrong tree.

I continue to stress the importance of supply-side policies and it looks like we’re finally gaining some steam.

September 24th, 2021: “Supply Is The Only Cause And Solution To Canada’s Housing Woes – It’s Time To Be Bold”

Well, I guess when Haider & Moranis write about it, people take notice. I’m just a wee, little blogger, after all.

It’s headlines like this that provide me with both joy and frustration; joy because people are finally realizing that supply is the issue, and frustration because it took so damn long for people to notice!

But when the Bank of Canada itself puts out press releases about “investors” being to blame for rising real estate prices, it simply clouds any attempt by economists or other informed, intelligent thinkers to promote the narrative that we need to build to solve the housing problem in our country.

The Bank of Canada. An arm of the government. How convenient! Is it too far-fetched to suggest that this helps the federal government avoid criticism and critiques of their actions (or inactions) and plans (or lack thereof)?

Now that sounds like fake news…

Happy Friday, folks!

Sanja Sanders

at 7:44 am

Sometime I don’t get it. There are still DETACHED houses with LAND you can get for $600K – $750K range in the Oshawa area. Yes they are not the greatest and kitchens are from 80’s but it’s workable and then you can renovate it slowly over the next 5-10 years. And get your behind on a GO Train and commute to Toronto like me! Same situation would be in most European cities so I don’t know where this privilege of ‘I must own a house in downtown Toronto’ comes from.

Sanja Sanders

at 8:14 am

Hello, can you please push back or delete my comment that was submitted earlier? My thought wasn’t finished and I pressed “post” my accident. Thanks.

Appraiser

at 9:05 am

“A sudden influx of investors in the housing market likely contributed to the rapid price increases we saw earlier this year. In such a case, expectations of future price increases can become self -fulfilling, at least for a while.”

-BoC Deputy Governor Beaudry

It is the above statement, usually accompanied by a “scary chart,” that’s causing all the stir and perhaps one that Mr. Beaudry may wish to clarify.

For example, the phrase “likely contributed” sounds neither declarative nor concise. Does the word “likely” betray the possibility that investors may not have contributed at all? And if investors are indeed part of the narrative, how influential was their contribution?

Chris

at 12:06 pm

There was indeed an accompanying “scary chart”, showing the extent to which investor activity has accelerated during the pandemic.

https://www.bankofcanada.ca/wp-content/uploads/2021/11/remarks-2021-11-23.pdf#chart4

Mr. Beaudry’s comments overall were pretty reasonable. He pointed to higher investor activity as a potential source of financial system instability:

“A sudden influx of investors in the housing market likely contributed to the rapid

price increases we saw earlier this year. In such a case, expectations of future

price increases can become self -fulfilling, at least for a while. That can expose

the market to a higher chance of a correction. And, if one occurs, the damage

can spread far beyond the investors. That’s because, for many households, their

wealth and access to low-cost credit are tied to the value of their home.”

He also discussed demand factors related to immigration, and the relative supply inelasticity of Toronto, Vancouver, etc., as compared to other Canadian cities.

It’s worth reading his entire speech. I didn’t perceive it that he was “blaming” investors. He was raising various factors that are impacting the real estate market, of which investors are one, and the vulnerabilities that this may exacerbate in the event of a shock.

m m

at 9:10 am

What about FINTRAC? Have we tried blaming them? I realize that they are not the culprit, but I do think that they should have been more attentive in the past 15-20 years.

Tony

at 9:31 am

Great take.

It’s all or nothing. Either ban ownership of property other than a primary residence or just leave the market alone to do it’s thing.

Shares of a house is a new low tho but that’s what people want then let ‘em have it.

Libertarian

at 10:25 am

David, back in the early stages of COVID, you wrote a blog that you were finally going to take the plunge and buy an investment property. Interest rates dropped so low you were getting free money and would use it to buy a rental property. Did you end up pulling the trigger?

On the topic in general, I agree with what Tony wrote. Either let the market be or ban investors. The issue I have with investors is that they always want more properties built. It creates a never ending loop. Investors want more and more properties to buy, even if it has nothing to do with the long-term planning of the community/region. That’s not good for our community.

But if we’re going to allow investors, then I think we should get rid of CMHC. If housing is a commodity, the government doesn’t have to be in the business of financing it. Same with all the other incentives the government has come out with since the CMHC.

Bryan

at 4:33 pm

I can’t for the life of me figure out why people believe investors are the problem here. I would actually argue that given the absolute dearth of purpose built rental properties in the city, condo investors are essential for Toronto to even really be a city people live in.

If you tax investors or disadvantage them in the market in some way, all that is going to happen is that a group of investors is going to sell off, reducing rental supply and causing rent prices will go up. Once this hits a certain threshold, another set of investors will step in to take advantage of the high rents that have made investing profitable again. The only people that will be hurt will be the poor souls renting from the investors…. at inflated rental prices to offset the tax(etc).

New builds need to match or outpace new household formations. That’s really the only solution. If that happens, rent prices will either stabilize or go down, as will selling prices, investors will gradually leave the market as other markets become more profitable, and all will be well!

Libertarian

at 1:42 pm

I agree with what you wrote. I don’t all these recent articles are talking about condos; they’re about houses. Investors have increased so much that people now feel they are an attack on the middle class. If people can’t afford Oshawa (and similar suburbs), let alone Toronto, then people are going to cry to the gov’t.

Marty

at 10:45 am

Happy Black Friday, all!

Todd

at 12:50 pm

You missed this article:

https://toronto.ctvnews.ca/mobile/first-time-home-buyers-in-toronto-being-pushed-out-by-investors-1.5678556

This one specifically blames investors for the fact that first time buyers can’t get into the market.

Graham

at 3:13 pm

Your boy John Pasalis was all over Key yesterday. Even planner-turned developer Jennifer Keesmaat called Key, “like Payday Loans for housing.”

Condodweller

at 3:43 pm

Assuming supply is what it is, i.e. constant for the sake of argument, if a + b = c where c is demand, a is investors and b is home buyers, would that not logically follow to mean that investors are increasing demand, thereby also increasing prices? Assuming higher demand equals higher prices with supply being constant (or not increasing enough for sake of argument)?

On the supply side, I would still like to find a good explanation as to what the benefit of high immigration is to Canada. Does this benefit outweigh the price we pay for the ever-increasing housing prices? Because part of b above is the immigrant population bringing money with them that allows them to participate. To those who say this is not true, I have posted article references in the past showing wealthy immigrants are coming to Canada and I also have first-hand experience with this.

Murasaki

at 8:54 pm

“A person, people, or a group, namely investors, flippers, speculators, realtors, foreign buyers, REITS, rich people, developers, politicians et al are responsible for the current price levels in our real estate market.”

David apparently forgot to include those traditional “folks to blame”: immigrants.

Condodweller

at 3:09 pm

People seem to be confusing “finding the cause” with blaming. In order to solve an issue, you have to find the source of the issue.

Mike Stevenson

at 2:39 am

Yes, of course investors are pushing up price substantially by adding to demand.

The benefit of immigration is that we’re an aging population with a birth rate well below the replacement rate. Stop immigration for just a couple of years, and suddenly look at all the staffing shortages. I get that is not the only reason for staffing shortages, but it’s huge and would be a long term crisis without immigrants. At least until automation arrives in a much bigger way.

Condodweller

at 3:29 pm

It’s a complex issue for sure. Given that housing is a long term issue and immigration solves, in part, staffing shortages which is more of a short term issue, perhaps they could issue work visas with the clear intention that once the job ends the person has to leave. I think we already do this but many are given permanent resident status and eventually citizenship. 100,000+ new people to the GTA per year is a lot of new housing demand whether they buy or rent.

mike stevenson

at 9:15 pm

FWIW, I don’t think our aging population is a short term issue. We need immigrants to propel our economy, in jobs both highly skilled and unskilled.

Condodweller

at 2:29 pm

Yeah, by “more of a short term” I really meant less of a long term compared to housing. If one buys a house they will be there for 20 30 even 50 years vs a job that even if it lasts 20 years it will be shorter.

Keith

at 7:13 pm

The benefit of high immigration to Canada is to politicians, and certain sectors, and a small portion of the population. The higher the immigration rate, higher GDP. The immigration masks our inability to increase productivity significantly. The GDP growth created is then shared pretty unevenly in the economy, which is why finance and real estate are so important to our economy. Politicians are all in on high immigration, the GDP growth is for today, and the lack of infrastructure, non market housing, all the other things you need will blow up on someone else’s watch.

David (Not the David who runs this website)

at 9:56 am

That’s a very good point that almost no one wants to bring up. We’re not doing anyone any good by bringing in 300k-400k to this country ever year. It puts enormous pressure on the supply of housing and it doesn’t do immigrants any favors either. There’s no way that we can build enough new housing every year to keep pace. Eventually, only the extremely wealthy will be able to afford a place to live in Canada. The rest of us will be in tents somewhere.

Kyle

at 6:06 pm

You are absolutely bang on, David!

John Pasalis, who is basically the real estate version of QAnon Shaman, and always pushing conspiracy theories on who to blame for high prices, has also jumped on this bandwagon that investors are to blame.

Investors are a symptom of scarcity not the cause of it. It’s no different than toilet paper over the course of the pandemic. People buying multiple packages of TP to either hold or resell came out in full force when there was supply issues, but as soon as supply was restored prices came back down and all those activities stopped. People don’t keep hoarding scarce resources when there is more than enough to go around, because there is no profit in it. That is how Economics works.

Chris

at 11:51 am

“John Pasalis, who is basically the real estate version of QAnon Shaman…”

“Investors are not the root case of high house prices.

There are so many other factors that are contributing to high house prices (population growth, monetary policy, tight supply)

Investors have had an outsized impact on the market in 2016/17 and in 2021”

https://twitter.com/johnpasalis/status/1463253683450359811?s=21

Comparing John to the guy who pulled his shirt off, painted his face and donned a Buffalo horned helmet while joining the storming of the Capitol seems a bit over the top, in my opinion.

Kyle

at 9:55 am

He may not wear horns, but when it comes to pushing disinformation, he is pretty much on par. He has pushed blame on foreign buyers, money launderers, the government, Tiff Macklem, empty condo owners, speculators, and now investors. Here is an absolutely clueless tweet if ever there was one.

“I said it last week and I’ll say it again

When investors are the biggest segment of your buyer base no amount of supply is enough”

– John Pasalis

His constant pushing of conspiracy theories on who to blame for high prices, so that he can ingratiate himself with the frustrated buyer crowd is so see-through.

Chris

at 10:15 am

He also doesn’t, to my knowledge, attempt civil insurrections, but I digress.

It’s worth reading John’s thoughts in more detail on the topic:

“Firstly, anyone arguing that the rapid acceleration in home prices is justified because of a “lack of supply” is not being entirely honest with you…

The fact is that when the dominant buyers of homes are investors, no amount of supply can ever keep up with the appetite and lofty expectations of real estate investors.

To see this in action, we only need to look at cities like Phoenix, Las Vegas and Dubai that have a relatively elastic (not constrained by land or zoning restrictions, etc.) supply of new homes.

Leading up to the 2008 global financial crisis, investors were a key driver of skyrocketing home prices in those cities and having a very elastic supply of housing did not stop them from experiencing a housing bubble which was followed by a deep crash in home prices.

Many economists also argue that it makes no difference if a home is purchased by an investor vs. an end-user, as long as the investor rents the home out. This again is not entirely accurate.

When investors are the dominant buyers in a market they push home prices much higher than they otherwise would be — preventing some end-users from buying homes for themselves. By financing the new construction of homes, such investors may help keep renting more affordable but they make owning far less affordable.

Additionally, having a larger share of investors in our housing market makes our housing economy (and thus our entire economy) far more vulnerable in the event of a sudden investor exit from the market. In my July 2021 report, I unpacked in more detail how investors particularly impact home prices (both on the way up and on the way down).

Now, I should repeat that while the trends I’m seeing on the ground — rapid price acceleration driven largely by strong investor demand — are troubling from a bubble-watching perspective, I don’t expect any dramatic change in the housing market and home prices anytime soon (as I discussed earlier in this report).

This type of investor-led rapid home price acceleration can go on for far longer than you might expect. As long as there is another optimistic investor around the corner willing to pay even more — prices will keep rising.

What is unlikely to rise as rapidly are rents, because unlike home prices, rents are truly constrained by household income. Home prices are a financial asset that when purchased by end-users may be constrained by income, but when purchased by cash-rich investors — the income constraint on prices no longer matters.

So this pronounced investor demand will continue until investors find that the gap between the carrying costs for their investment property and the rental income they may generate from it is too large. If that happens, then the optimistic investor may suddenly turn very pessimistic, much like they did during the initial onset of the Covid-19 pandemic when investors rushing to sell their downtown condos caused prices to suddenly fall.

Given this, it is important for consumers of real estate to be aware of potential issues, particularly in some segments of the housing market, in light of these troubling signs.”

https://www.movesmartly.com/monthly-report-november-2021

If you’d like to posit why you disagree on this, I’m sure it would make for an interesting read. If all you have to offer in rebuttal is that he’s akin to the QAnon Shaman, and is clueless, while providing no elaboration, well, that’s a bit less compelling.

Kyle

at 10:36 am

Very easy to rebut his nonsense….

https://www.wsj.com/articles/what-housing-crisis-in-japan-home-prices-stay-flat-11554210002

https://mises.org/wire/why-housing-more-affordable-tokyo

Chris

at 10:59 am

Rather than looking to Japan, why not look to our own backyard?

As per the Bank of Canada, Regina is the CMA with the lowest supply elasticity, slightly below Toronto. Kitchener-Cambridge-Waterloo, by comparison, has one of the highest supply elasticities of the nation.

https://www.bankofcanada.ca/wp-content/uploads/2021/11/remarks-2021-11-23.pdf#chart2

There’s a link just above the chart if you’d like to read the full research paper by Nuno Paixao of the BoC. It examines how increases in the demand for housing, such as through population growth, impacts house supply and prices. As an aside, it’s worth noting that the paper found that many Canadian cities have very elastic housing supplies.

From January 2005 (the furthest back CREA’s data reaches), Regina’s Composite HPI has grown from 100 to 249.9. Over the same period, Toronto has grown to 369.4, while KCW has grown to 409.6.

Though factored into the supply elasticity research above, population growth for the Toronto CMA from 2016 to 2020 is estimated at 10.58%, for Regina at 11.29%, and for KCW at 13.36%.

There seems to be more at play here than simply supply.

Kyle

at 11:08 am

It should be obvious why we look at Japan. We’re talking about international alpha cities, that have large growing populations, with many high paying jobs (i.e. not Regina). When you look across the world at these types of cities they’re all unaffordable, Tokyo bucks the trend. There are lots of rich people in these cities (Tokyo included), who can afford to buy up many properties, but Japan’s elasticity allows it to grow without a crisis.

Chris

at 11:23 am

“We’re talking about international alpha cities, that have large growing populations, with many high paying jobs (i.e. not Regina).”

No, we’re not talking only about alpha cities.

As another aside, most rankings of global cities put Toronto in a lower tier than Tokyo, but again, I’m getting off topic.

Look at the articles David cites in this blog post; they reference Canada and Ontario, not Toronto specifically. His blog post today states that “The Problem With Housing In Canada Is Lack Of Supply!”, though admittedly the data he shares focuses on Toronto.

Cities such as Kitchener-Waterloo and Hamilton have seen price growth outpacing Toronto (despite greater supply elasticity), and unaffordable housing. YoY price growth last month in New Brunswick was 30%.

This goes beyond simply Toronto, or even the GTA. Hence, it’s worth looking at more than only Tokyo to form our opinions and conclusions.

Kyle

at 11:36 am

Sorry i should have said,

“It should be obvious to anyone looking for real answers and not just to nit pick words, why we look at Japan”.

Take all the top cities across the globe, regardless of what their tier is (because that is irrelevant) and they all suffer the same affordability problems, EXCEPT Japan. Which is the one place that doesn’t have restrictive supply. Like i said obvious, but you go on and cling to Regina vs Kitchener.

Chris

at 11:52 am

Certainly, many like London, New York, Paris, etc., are unaffordable.

Though, even in these cities, pricing seems to decline much more steeply as you leave the cities, such that a home at say Hamilton’s distance would be much more affordable than Hamilton real estate currently is.

Others, like Chicago, Boston, Berlin, Amsterdam, Madrid, etc., seem to be more affordable, though more expensive than secondary cities or rural areas in the same countries.

You’re free to compare to Tokyo if you so choose. I personally think there’s more value in looking to research published by our own central bank on the supply elasticity of our cities, price growth rates, levels of demand, and what that data implies.

Have a great day, Kyle!

Kyle

at 3:16 pm

Oh look he’s found someone new to blame today:

“Any time the Liberal’s blame Harper for high home prices – remember this.

Under Harper Toronto home prices were rising by around $25K per year vs $80K+ under Trudeau.

If the dream of homeownership is dying, it’s Justin Trudeau’s government that is killing it!”

– John Pasalis

Chris

at 4:49 pm

It seems pretty clear from John’s comments that he’s addressing claims from LPC and supporters that Harper is to blame for expensive housing.

Hence the opening line of “Any time the Liberal’s blame Harper for high home prices…”

Chris

at 5:02 pm

Here’s John’s tweet:

https://twitter.com/JohnPasalis/status/1465773331676909574

And the tweet he is quoting states:

“The reason we have a housing crisis is because of the Tories didn’t show any leadership, says Canada Liberal minister of housing. Liberals have been in power since Nov., 2015. Tories in power from 2006 to 2015.”

Kyle

at 7:01 pm

Not sure how your apologist comments make him look any better, as if who he’s addressing makes a lick of difference. My point about him making up people to blame for high prices totally still holds.

Chris

at 7:47 pm

He’s addressing a claim that the CPC is to blame, by pointing out that prices have grown much faster under the Liberals – therefore, if any individual politician is to blame, it would be Justin Trudeau.

You seem to have a strong dislike of Pasalis, which I suppose is your right, but it appears to be distorting your perception of his comments. This isn’t him “making up people to blame”; it’s responding to a politician’s assertion.

Anyways, have a great night, Kyle!

Kyle

at 8:01 pm

I know how upsetting it is for you when reality conflicts with what you want to believe, so it maybe best if you don’t click the link below:

https://twitter.com/JohnPasalis/status/1462830065671188486

Have a great night too!

Chris

at 8:10 pm

Oh wow, what an upsetting Tweet! Good thing you warned me before I clicked that!

Night, pal!

Kyle

at 8:59 pm

Glad the warning helped. I remember all those other times you had to face reality and you became downright ornery. So credit where credit is due. Good progress mate!

Keith

at 7:08 pm

The population of the city of Vancouver increases by considerably less than 10,000 per year. There’s easily 20,000 units of market housing being built per year, and it’s one of the hottest real estate markets on the planet with dramatic price increases. Whatever the issue is, it’s certainly not a lack of current supply vs current population trends.

As for supply constraints, certainly developers don’t start building without sixty to seventy percent of a project being presold, so land banking is likely an issue, as much as complaining about municipal bureaucracy. The fastest cities in the lower mainland issue building permits 5 to 6 times faster than Vancouver, but the prices are uncomfortably close to those of the regional anchor. Faster permitting doesn’t lower prices.

Zoning? Ninety nine percent of single family lots in Vancouver have been zoned for three to four units in the last two decades. Every density increase so far has increased land values in excess of any affordability gains. Every single one. It’s the price of land which has grown the fastest, and show no sign of slowing down.

There are no shortage of targets to blame – foreign buyers, speculators, lack of supply, parents gifting money, people who own a home outnumber first time buyers. It doesn’t matter. It’s all part of a long, slow melt of the giant working and professional middle class into having less than their parents generation, at much higher cost, and with far less security. It’s a long running trend in society, and there doesn’t appear to be a force to counteract it. No government wants real estate to crash on their watch, so meaningful changes that would correct or crash the market never happen. The dance continues,

Jonathan C

at 5:00 pm

“It’s all part of a long, slow melt of the giant working and professional middle class into having less than their parents generation, at much higher cost, and with far less security.”

This is a feature of neoliberal capitalism, not a bug. The wealthy and politically well connected benefit from higher asset prices and stagnant wages caused by unchecked immigration, while the rest of us are slowly ground down into “you’ll own nothing and be happy”.