For months the talking heads have cited the ultra-low rates, the shortage of new homes being built, stock market, millennials, covid, etc. as reasons why the real estate market has exploded.

Let’s add a few no-so-obvious reasons.

Did we fully recover from the last downturn? We know that because Bernanke and the banks unilaterally changed the rules to rescue the MBS investors, we never hit the true bottom. The short-sales muddied the water further because there were so many that were never exposed to the open market and sold instead at artificially-low prices by unscrupulous realtors. In 2010-2014, we saw it here on the blog where many commenters expected the downturn to last for at least a few more years, and even the Frenzy of 2013 didn’t convince everyone we were out of the woods. Low (but not ultra-low) rates made it interesting, but there wasn’t enough confidence for buyers to flood the streets desperating seeking a home to buy – though in hindsight, they probably wish they did.

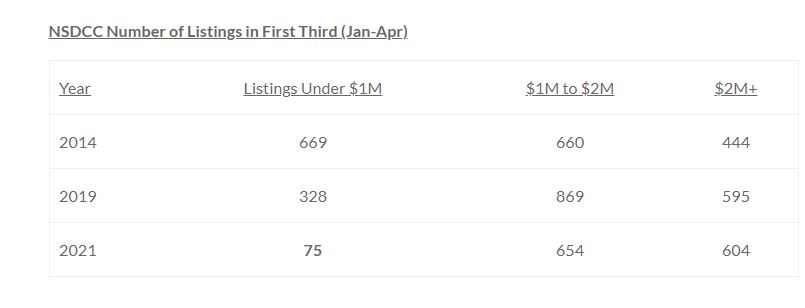

The lower-end inventory has been decimated by rental conversions and aging-in-place. Because the rents have exploded, any of those homeowners who didn’t have to sell their existing home had to consider hoarding their prized possession that was probably the best investment they ever made and turn it into a rental instead. The high costs of senior care is causing many if not most to age-in-place, and besides, one of the kids or grandkids can take over and assume the low tax basis. While pricing is flying on the lower-end today, it’s a recent occurrence that the appreciation has been 2% to 3% per month. If there had been more listings in recent years, we would have had prices rising faster, sooner. In the chart above, the rest of the categories look fairly uniform – it’s the lower-end that has changed drastically and having the most impact on the frenzy upstream.

The builders never got the memo about open bidding. Still to this day, it is first-come, first serve. Pardee is down to their last 20-30 houses ever in Carmel Valley, they were taken over by Tri-Pointe, and they have nothing left to lose. You know there has to be 50-100 people waiting on their buyers’ list yet they only release 2-4 homes per phase. Toll Brothers sold two of their models for $4,000,000+, yet Pardee is keeping their production homes attractive priced in the mid-$2,000,000s. If they just opened up the bidding at each release to ALL the buyers on the list, they would pick up an extra $500,000 easily – just because if you are number 50+ on the list, you’re not going to get another chance. But they don’t do it, which is keeping a lid on pricing. Because most everyone is buying their forever home, there won’t be enough turnover in the next few years to generate the momentum needed to find the real top-dollar value.

There are three examples of what has been undercutting the trajectory of home pricing.

When we have BOTH sales and pricing on the rise exponentially like we do now, it demonstrates what is possible when you take off the inhibitors. We are probably running a little hot today – can we be so undervalued that this frenzy could keep going for months or years?

Perhaps – especially if there are new market factors we haven’t considered before!