ICE Mortgage Monitor: The Impact of "Golden-Handcuffs" on Mortgage Payments

Calculated Risk Real Estate

APRIL 1, 2024

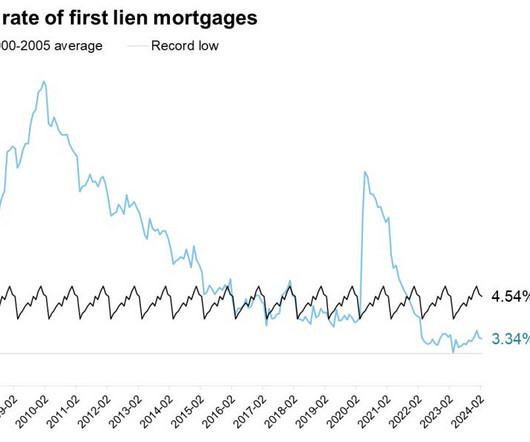

seasonally adjusted annualized rate There are many headwinds facing the would-be seller in today’s market, making their existing mortgage payment particularly attractive in comparison.

Let's personalize your content