CFPB report focuses on ‘discount points,’ but paints an incomplete picture

Housing Wire

APRIL 8, 2024

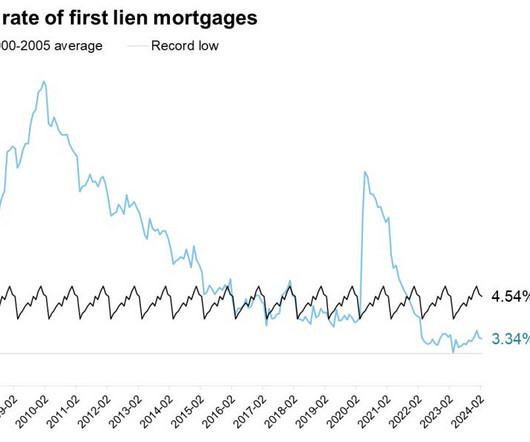

The elevated rate environment has made future refinancing options less clear for borrowers entering the market today, but CFPB also expressed concern over the disproportionate application discount points have on borrowers with lower credit scores. “The GSEs added LLPAs to additional loan types and credit score bands,” he said.

Let's personalize your content