Builders rediscover a tool from the 1980s that keeps new home prices from falling

Housing Wire

DECEMBER 12, 2023

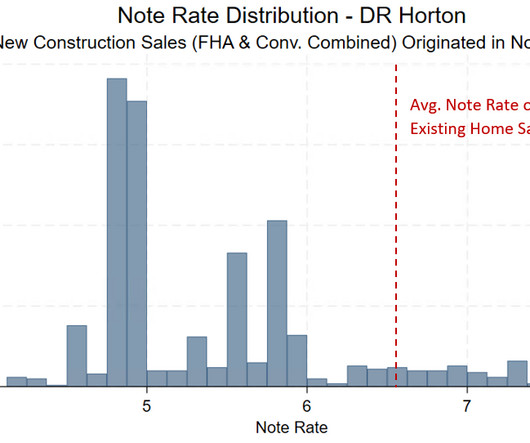

This phenomenon becomes clearly apparent when compared to existing home sales, for which these buydowns are very rare. As shown in the chart below, existing and new home sales for the 19 largest home builders had roughly the same note rates until January 2022. As of July 2023, the gap had slightly narrowed to 0.8 2022 to Dec.

Let's personalize your content