CFPB report focuses on ‘discount points,’ but paints an incomplete picture

Housing Wire

APRIL 8, 2024

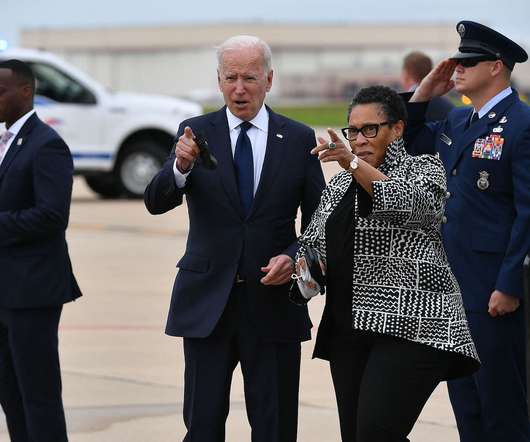

This is the latest development in the Biden administration’s war on so-called “junk fees,” with the CFPB pointing out a desire to closely monitor the impacts of discount points in a blog post published in early March. “The GSEs added LLPAs to additional loan types and credit score bands,” he said.

Let's personalize your content