Not only are my fingers tired from writing Monday’s blog, but also from hand-writing three-hundred Christmas cards! Cards and envelopes!

Yes, I do that. I do it with pride.

What’s the point of sending a holiday card if it’s obvious that your assistant or some high school kid wrote them for you? Any layman can identify those scribbled CAPITAL BLOCK LETTERS as the hand-writing of a 40-year-old man.

I always think I prefer the “Top Posts” to the “Top Stories”, but then I sit down to write the top stories, and I realize that this is a thicker, fuller experience.

Having worked with this theme for over a decade, but only this specific process of the two “Top Five” lists now going on six years, I figured it might be fun to refresh:

Top Five: Real Estate Stories of 2015:

5) Urbancorp “Stealing” Their Condos Back

4) Real Estate Commissions

3) The Media’s Continued Obsession With The Pending Real Estate Collapse

2) CMHC, The Bank of Canada, & Monetary Policy

1) The Market

Top Five: Real Estate Stories of 2016:

5) New Mortgage Regulations

4) Foreign Ownership

3) The Business Of Real Estate And The Real Estate Industry

2) Kathy Tomlinson & Vancouver Real Estate

1) Prices

Top Five: Real Estate Stories of 2017:

5) International Real Estate

4) Rental Market

3) Business of Real Estate

2) Government Intervention

1) Spring Insanity

Top Five: Real Estate Stories of 2018:

5) TREB vs. the Competition Bureau

4) The 2017 Market

3) The Rental Market

2) Financial Literacy And Personal Responsibility

1) The Future Of The City Of Toronto

Top Five: Real Estate Stories of 2019:

5) Prices

4) The Inner Workings Of The Real Estate Transaction

3) Professionalism In Real Estate

2) Government Intervention & Politics Affecting The Market

1) Help

–

Wow, I really knocked it out of the park in 2019! Those topics are really deep! And lots of links to blog posts in each section too.

I almost think the 2020 version will be boring when lined up against those beauties, but you guys can let me know.

I feel like, as 2020 was the most complicated year of any of our lives, the “Top Five” seem almost simple by comparison. I can’t figure out if that’s fitting or ironic…

Because this will likely be at least double the length of my average blog post, let me get right into it…

5) People Moving Out Of The City

This has been a story for a couple of years now, but it’s never made its way onto our “Top Five” list. Not even close.

Over the weekend, I received a text message from a client of mine about selling her home.

This client goes way, way back for me.

I rented her a condo back in 2007 when she finished university and got her first job downtown.

I sold her and her boyfriend a condo in 2009 when they were ready to jump into the market.

I sold them a house in Bloor West Village in 2011 when they were outgrowing the condo and looking to plan a family.

And now, like many others, they’re leaving Toronto.

“We bought a house,” she told me on the phone. “We’re heading up to Horseshoe Valley to plant some new routes, and start a new life.”

They have family up there, both of them. Both mothers live north of Toronto, and his two brothers as well. With family support dramatically rising up all of our collective “needs” lists in 2020, more and more people are moving closer to family, even if that means making major life changes.

When I saw that text about selling their home, I figured they’d probably bought out of the city, and the ensuing twenty-five-minute phone call was quite familiar.

After all, it wasn’t the first time I had experienced this in 2020.

I always keep things anonymous, but a client of mine was recently featured in Toronto Life, so I figured I’d add some “colour” to this story:

“A Toronto Couple Could Work Remotely. So They Moved To This $1.6 Million Blue Moutain Mansion”

Chrissi is the older sister of one of my “baseball kids,” who I met when I started coaching in 2007. All those “kids” are now men, and many of them have bought houses through me. Hell, one of them works for me…

I am insanely jealous of Chrissi and Parker, not just because of the Blue Mountains house that they purchased, but also because they had the guts to do what they did.

A lot of people talk about “starting a new life,” but these guys actually did it. They were looking at houses in Toronto, but it never felt right. We looked at a few places, but I could tell their heart was outside of the city. In the end, it made perfect sense. You’d have to know them to know why, but they’re just the right “fit” for that house, that area, that life, and that move.

They purchased that Blue Mountains house firm, and we sold their condo in July right before the market changed dramatically.

July 20th, 2020, I wrote: “I’m Moving Out Of The City!”

In the post, I detailed five clients of mine who moved out of Toronto this year.

Two to Burlington, one to Stratford, one to Niagara-on-the-Lake, and the couple I described above who moved to Collingwood.

Since I wrote that post, I had one more couple sell their part-time house in Toronto and move to Brantford full time, one couple sold their North Toronto home and moved to Niagara Region, and one sold his condo to move north of the city.

This isn’t a trend, and it’s not going to stop either. Whether it’s the price of real estate in Toronto, flexibility in the work-from-home movement, or a societal change with respect to how we value our work/life balance, I expect to hear from more clients in 2021 who want to move out of Toronto.

I certainly wasn’t the only person writing about this topic in 2020!

If you want more coverage:

July in Toronto Star: “Torontonians Are Fleeing The City For Cheaper Homes, More Green Space, And A Balanced Life”

August in Reuters: “COVID-19 Speeds Up Home Buyer Exodus From Toronto”

September in Now Magazine: “Why People Are Leaving Toronto For Greener Pastures”

Not all stories are glorifying the movement, however.

October in The Globe & Mail: “Moving Out Of The City Is A Recipe For An Infernal Commute”

And not all the people selling in Toronto are “moving out of the city,” since there’s one story about people who can drive back into it:

August in Toronto Life: “After The Pandemic Hit, We Cashed In Our House And Moved Into A Camper Van”

I’m tied to Toronto forever.

I sell real estate in Toronto and I write the TORONTO Realty Blog.

As much as I would love to lead the simple life with my family in Prince Edward Island, or move to Idaho and join my friend Tayson who writes the “Teton Realty Blog,” I’ll be here for the foreseeable future.

But you, you, or you, might not be.

You just never know…

4) Refusal To Accept Market Reality

This could be a topic in any year, really.

But when real estate prices drop, even modestly, two mindsets begin to sink in for some sellers:

- Greed

- Stupidity

On their own, these are awful.

But together these are an unmerciful combination.

It’s kind of funny, because when we began 2020 and prices were continuing to rise, we started to see some “affordability” ideas out there that I thought were just downright bonkers, and that’s the other side of the “refusal to accept market reality.”

Because when the market is rising, some wanna-be buyers will refuse to accept that these prices are real, and of course, they jump on the bearish-bandwagon, and concoct all kinds of situations in which the market will drop to a price that makes sense for them. At the same time, the various levels of government will also fail to see this market as a reality, and often they’ll come up with outlandish ideas on how to “fix” the problem.

January 31st, 2020, I wrote: “The Friday Rant: This Is A Terrible Idea”

This blog post was in response to the government’s suggestion that co-owning a home was a good idea.

“Ontario’s Housing Supply Action Plan: Co-Owning A Home”

I was so frustrated with this 14-page booklet, I can’t even begin to explain. I mean, I tried, in a 2,400-word blog post in January, but the government’s inclusion of this photo set me off:

That is the photo included in “Example 2: Access to Home Ownership,” which explained how a group of young adults could buy a property together.

As I wrote in my January blog, I don’t see any five young adults EVER entering into a co-ownership without failing spectacularly at some point.

I understand the plight of young adults looking to get into the real estate market, but telling five 20-somethings to pool their money and buy a house is ridiculous. It’s irresponsible, and since we have the leadership and live in the political climate that we do, you just know the government will be called upon to bail these people out when they have issues.

Now, as the theme goes in just about every one of these “Top Five” stories of 2020, the market changed in March when the pandemic came upon us, and we went from looking at buyers refusing to accept market reality (not to mention the government, on their behalf…) to sellers refusing to accept that a worldwide pandemic just might reduce the value of their homes by a penny or two.

And it wasn’t just buyers and sellers that refused to accept market reality, but I’d say market onlookers are guilty of that too.

Once again, I think back to the “bet” that the TRB readers and I had in the spring about when the GTA average home price would surpass the $910,290 that we saw in February, having plummeted to $820,373 in April.

For those that didn’t read, or can’t recall, here were the predictions among the readers and myself:

Thomas: June or July 2020

Kyle: Fall 2020 or April 2021

Tony: January or February 2021

David: April 2021

J G: April 2021

Derek: April 2022

Condodweller: Feb 2023

Mxyzptlk: April 2023

Chris: April 2024

Pragma: 2028

Potato: Sometime in the 2030s

Jeff: Never (adjusted for inflation)

–

July 8th, 2020, I wrote, “Winner, Winner, Chicken Dinner”

Blog reader “Thomas” won our contest, and it wasn’t even close.

I’m not looking to beat a dead horse here since we’ve discussed this multiple times since then (including on Monday!). But this is yet another example of people not wanting to accept the market reality in our city. And while I’m not going to suggest that any of us knew when or how society would bounce-back from an unprecedented pandemic, I do think it’s ludicrous for people to suggest that it would take five years, or ten years, for the GTA average sale price to pull even with February’s price, let alone never.

But in the end, that contest and the subsequent blog post would both pale in comparison to the legion of willfully-uninformed sellers who had illusions of grandeur throughout the latter-half of 2020.

September 30th, 2020, I wrote, “Take Your Medicine”

Stories like this were so common-place in my life this past fall that I had to force myself not to write the same thing over and over!

Half of the condo-owners in the downtown core use the word “need” in place of “want” when they detail the price they’re looking for, and then fail to understand that “want” has no effect on market price.

Most condo sellers seemed to feel like they were negotiating with the market, or their own listing agent, while refusing to accept that prices had dropped.

Take a seller with a condo worth $700,000 in February, and tell them they could expect to get $650,000 now, and they’ll say, “I’d probably let it go for $685,000” as though they’re being a hero for taking a discount, and as though they’re in any position to dictate terms.

September 16th, I wrote, “What Pricing Tactics Will Not Work This Fall?”

Here I examined a property that has been listed over and over, by a seller who refuses to accept market conditions and pricing, and explained that buyers need to watch out for listings like this in the coming fall market, and avoid wasting time on them.

September 23rd, 2020, I wrote “Frustrating Fall”

In this post, I detailed all of the emotions that buyers and sellers are feeling: regretful, impatient, misled, envious, jealous, discouraged, helpless, abused, reflective, and perplexed.

October 15th, 2020, I wrote, “What Does List Price Mean This Fall?”

This was borne of frustration with sellers who have no idea what their property is worth, but also no clue how to list and sell in this market.

It felt as though every other blog post from the summer onwards was about a seller who was doing something stupid, to the point where it almost got old.

We see pricing games in every market, but in 2020, the “nonsense level” was at an all-time high. I would argue that it even surpassed the ridiculousness of 2017 after the market dropped and every seller listed their property artificially-low, failed to sell on “offer night,” and then re-listed higher.

The problem in 2020 wasn’t just that sellers were greedy, it’s that they had no idea what “value” was anymore, not to mention, what pricing strategy to use in order to attain it.

Will this continue into 2020 if the condo market remains depressed?

I expect it will, except for those sellers who truly “need” to sell…

3) The Rental Market

“I’ve never seen anything like it.”

That’s a sentence that I’ve repeated many times throughout 2020, for many different reasons. But when it comes to the rental market, I was saying this quite often.

“I’ve never seen anything like it,” I would tell a client, after failing to have one, single viewing on a property listed for lease, inside of three weeks.

“I’ve never seen anything like it,” I would say to the would-be landlord, faced with renting a $2,400 per month condo for $1,995.

But it’s true. I’ve never seen a rental market quite like what we saw in 2020, and once again, this was at least, in part, due to the pandemic.

Rents have absolutely skyrocketed in the downtown core over the last few years, there’s surely no doubt about that. We’ve seen countless news stories about the plight of today’s would-be renter, and several times since April of 2017 we’ve seen new legislation aimed at protecting renters, and/or keeping the cost of rent lower.

Before April of 2017, it wasn’t uncommon for a landlord to evict a tenant based on “personal use,” and then simply change his or her mind and sell the property. I saw my own clients do this on several occasions and they got away with it every time. In 2017, the Ontario government introduced the “Rental Fairness Act,” and upended the rental landscape as we knew it.

The most notable changes in 2017:

1) Properties built after 1991 were covered by rental increase guidelines

2) Eviction for personal use required the landlord or a member of the landlord’s family to live in the property for 12 months

3) One month’s rent would be given as compensation for eviction

4) Introduction of a standardized rental agreement known as the “Ontario Standard Lease”

And what effect did these changes have on the rental market?

None.

Prices just kept rising.

In fact, I would argue that these changes had an adverse effect, since landlords knew once a tenant was in their property, it would be near impossible to get that tenant out! So landlords became far more stringent in their selection process, and to be competitive, tenants began offering multiple months’ rent up front as a deposit.

Prices rose to a point where I simply couldn’t believe what people were willing to pay to live downtown, and this, in turn, drove up the price of the resale condo market.

Consider a flashy, new, shiny building, where some young person felt it made sense to pay $2,200 per month for 450 square feet, with no parking space. All that meant was that the owner could justify a higher valuation and potential sale price and that developers could raise their own prices in pre-construction.

For the life of me, I couldn’t understand where young people were getting this money, or why they chose to live downtown and pay nearly $30,000 to live in a tiny box. Call me hypocritical, since I lease properties on behalf of my landlord clients, but far be it for me to suggest that these people can live outside the downtown core, or in a multi-plex, or even live at home with mom and dad longer – which is something I advise a lot of people to do!

Prices were rising, and greed was taking over.

And FYI, I don’t always side with the landlords, just in case it seems that way.

March 11th, 2020, I wrote “Illegal Evictions: Real Life Examples!”

I was so frustrated with the arrogance and entitlement of these landlords that I decided to print their full emails (with names redacted) on TRB.

Have a read, in case you never saw this back in the spring. One is from a property manager illegally evicting a tenant, and the other is from a landlord who tries to raise the rent, illegally, and then when the tenant calls out the landlord with a link to the legally-permitted rental increase, the landlord simply says, “Thanks, you were great tenants, we’ll advise you on next steps soon,” as though ‘were’ was in past tense, like it’s a foregone conclusion that the tenants are being evicted.

That bothers me to no end. Just because I disagree with some parts of the rental legislation that makes it impossible for landlords, doesn’t mean I’m okay with BS like that!

But you know what? Sometimes, the world has a funny way of working things out on its own.

Because just when you thought the rental market couldn’t get any hotter and thus harder on tenants, the pandemic came along and turned the rental market on its head.

Job losses meant that some tenants had to leave their rentals.

Universities closing meant that many people decided not to move downtown.

The “work from home” movement meant some would-be tenants could stay where they were, or others could move out of the core.

International students stayed home.

The lack of AirBnb rentals meant those property owners were now listing on the long-term rental market.

And in the end, the rental market went soft.

Inventory shot up, rentals plummeted in March and April, and prices dropped accordingly.

The media inundated us with stories about tenants securing rentals for $1,800 per month that used to cost $2,350, but I felt there wasn’t enough coverage about those fully-employed tenants who used the pandemic as an excuse to be delinquent on their rent. This happened a lot, as you can imagine. With Doug Ford telling people, directly or indirectly, that it was alright to not pay their rent, people listened!

July 27th, 2020, I wrote, “What Can A Landlord To To Protect Him/Herself?”

This was in response to a massive rental scam uncovered by a colleague of mine, and it was truly scary stuff!

In 2020, I completed twenty-two leases for my landlord-clients, which is a shocking number, considering I usually don’t take on rental listings. But these were all existing clients whose tenants gave notice, and they came to me for help!

As I write this, I have two rental listings on the market.

One was last leased in 2017 for $1,995/month, with comparable listings renting for $2,350 in early-2020, but for which we’re now priced at $1,895/month and have been on the market for 82 days.

The other was last leased in 2018 for $1,995/month, and is now listed at $1,850/month without a single showing after 36 days on the market.

Those are the only rental listings I have left, and I consider myself lucky to have moved the other twenty-two units. Some had challenges, some were easier to move than expected, but overall, 2020 was an absolute slog in the rental space.

November 11th, 2020, I wrote, “The Most Over-Saturated Rental Buildings In Toronto”

If you own a 1-bed, 1-bath condo and you’re trying to rent it out, but there are TWENTY similar units up for lease in the building at the same time, what the heck can you do?

That’s how tough it is for landlords right now, and as you’ll read later on in this blog post, the result has been downward pressure on resale prices.

November 23rd, 2020, I wrote “What’s Happening With Rent Discounts?”

This is what many landlords have resorted to in order to attract tenants but try to protect themselves in the future, and as you’ll read, many landlords and listing agents have no clue what they heck they’re doing.

I do expect the rental market to improve in 2020, but I think it may take until the spring.

For now, we can look back at 2020 as perhaps the worst rental market in recent memory, which has half of us rejoicing, and half of us lamenting…

2) The Condo Market

Points #3 and #2 have some overlap, no doubt about it. There’s a bit of a “chicken-and-egg” situation going on here.

But they are, on their own, different stories, with different protagonists, and they affected people in different ways.

And when you consider how red-hot the condo market was to start 2020, and where we stand now, it truly warrants the #2 ranking on this list.

January 20th, 2020, I wrote, “Does January 2020 Feel Like January 2017?”

And you know what? It did!

Every morning, we would hear about this condo or that condo and how many offers there were, what ridiculous price was paid, and then we’d see what else came onto the market that morning and try to set expectations accordingly.

I simply cannot begin to explain how quickly condo prices were rising, you just wouldn’t believe me. You couldn’t.

A client of mine purchased a condo in DNA for $580,000 in October of 2019 for $550,000. In January, the same model sold for $605,000. That was nuts, right? Exactly 10.0% higher in only three months?

Well, guess what happened in February? The same model sold for $660,000. Nuts, right? And I can’t figure out what was more shocking; the fact that this third unit sold for 9% more than the second one in only one month, or that the third unit was 20% higher than the one my client purchased in only four months.

Some of you will look at this and say, “What goes up, must come down,” or suggest that this was “a sign of things to come,” but I honestly believe that if it weren’t for the pandemic, we’d have seen condo prices continue to rise, or at least remain flat.

March 9th, 2020, I wrote, “February TREB Stats: Chaos Is A Ladder”

This was right before the pandemic hit us hard, but we didn’t know what was coming!

February saw the third-largest month-over-month increase in average home price in eight years!

And with condos specifically, February saw the 7th-largest month-over-month increase in the 416 in that same time period from January of 2012 to February of 2020.

The average 416 condo price in February was $722,675, representing the highest all-time price, pre or post-pandemic.

That price was up 6.4% from January alone, 10.1% from December, and if you want to go back to the start of last fall, it was up 13.4% from September.

Anecdotally, I told you stories above about 20% increases inside of the same time period, but consider that the “on paper” numbers always lag behind the anecdotes and stories from the trenches, and a 13.4% on-paper increase is quite telling.

As you’ll read in my #1 point below, it wasn’t long after this March 9th blog post that the world changed, and the market changed with it. But as we noted here on Toronto Realty Blog throughout the rest of the year, while the freehold market recovered, and we saw a major increase in the TRREB average home price, the condo market was left behind.

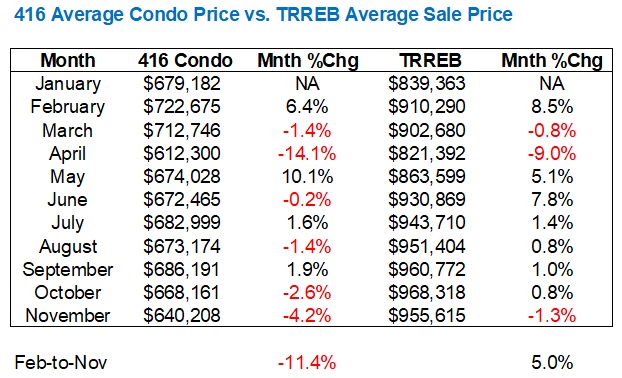

I showed you this chart as recently as last week, but have another look:

Using the pre-pandemic “peak” in February, we see that the average 416 condo price is still down 11.4% since then, while the average TRREB sale price is up by 5.0%.

We see this now, two weeks before Christmas, but let’s remember that it was a long, slow burn from March onwards.

August 26h, 2020, I wrote, “Market Snapshot: How Are Condos Doing Thus Far In August?”

This was the first time that I really felt we were going to see downward pressure on condo prices, and it was the same two culprits that are always responsible; our good friends “supply” and “demand.”

No more than two weeks later, September 10th, 2020, I wrote, “Top Five Burning Questions For The Fall Market,” and one of the questions at the top was “What is going to happen to the condo market?”

As you read in Point #4, there were a lot of ensuing blog posts about sellers “taking their medicine” with respect to selling at current market prices, but with condo prices going down each month in the fall, many sellers took a month or two to come around, and when they did, they found prices were even lower!

November 9th, 2020, I wrote, “The Most Over-Saturated Condos In Toronto”

In this blog post, we identified that there are some condos in the downtown core where upwards of 8% of the building is for sale!

If you’re a seller in the newly-registered Massey Towers, how do you plan to compete against the other thirty-three units for sale in the building?

2020 was a tale of three condo markets: the rapidly-appreciating first two-and-a-half months of the year, the pandemic drop and lull thereafter, and the fall market and onwards, the latter of which cemented the damage inflicted by the pandemic earlier in the year.

Some feel that this is only the beginning, and point to changes in work environments and a lack of overall demand as reasons why we could see further depreciation. Others see this as a buying opportunity and recognize that buying puts upward pressure on price, and that prices can only drop so far before institutional money jumps in and buys significant amounts of property at reduced prices, with eyes on the long-term

I don’t think condo prices are going up in December, and by the time we meet again in January, I’ll be talking about an average 416 condo price that’s lower than the $640,208 that we saw in November. But I do, however, believe that by the spring or early summer, that number will be up into the $660’s, $670’s, or $680’s again. We may take some time to get back to $722,675, but we’d be fools to think the bottom will extend into mid-2021.

1) The Pandemic

You were hoping this wasn’t numero-uno on the list, right?

The pandemic has dominated, defined, and disheartened all of us in 2020, and many of you read Toronto Realty Blog as an escape, for however long, from lives and work that are constantly shaped by COVID.

So for that, I’m sorry.

But no matter what list you’re reading at this time of year, COVID is going to be involved.

Yes, the pandemic has been a part of just about every story thus far, but on its own the pandemic is still atop our list. And what’s more, is that we will be talking about this pandemic for the rest of our lives, make no mistake. We all want to think that by the time we’re vaccinated and walking around in society without masks on, dining out with glee, and hugging strangers, we’ll never say “COVID” again. But this experience has become a part of us, and even if and when we leave it behind, we’ll be telling stories for years to come.

I remember walking into Staples toward the end of February and I saw the most incredulous thing: a mother-daughter duo walking out the front door, pushing a shopping cart, and both of them were wearing masks and gloves! It was insane. So insane that I took a photo and sent it to my wife!

Did I ever think that wearing a mask and gloves was not merely just around the corner for me and the rest of society, but that it would become law during a series of shutdowns and quarantines throughout the rest of the year?

All of us could probably identify that “first time” we heard of the coronavirus. I believe mine was in late-January, and it was one of those “this has to be fake news” conversations around the proverbial water-cooler. Then came the real news out of China, and more rumours and broken telephone.

I wrote earlier this year about how one of the agents on my team was trying to get a mutual release for a condominium purchase that had fallen through, but the condo owner was unreachable. He was in China and, apparently impossible to contact.

Imagine that?

I’d been around a long time, and nobody is unreachable. All the nonsense about needing 24 hours on an offer because the seller is in a different time zone – that’s just noise! So here I was, in February, being told that people in China were being forced to stay home? Lies!

The listing agent for this Toronto condo was telling me, “You don’t understand! People in China can’t go to work, or leave their homes, or walk the streets! They’d be arrested if they were found in the streets!”

This was complete garbage, of course. It was like something out of a bad science-fiction movie.

Only, as history will show, this all proved to be true! And all along, I was getting a preview of what was to come, worldwide. I just didn’t believe it. Who could?

Our first confirmed case of the virus happened on or around February 28th, and we really paid it no mind.

In Ontario, we didn’t see double-digit daily cases until March 12th, and at that time, I was still selling real estate, people were still working, and nobody was the wiser.

March 16th, 2020, a day that will live in infamy, in my mind, at least.

This was the last normal day of my life, before the pandemic.

At 7:00pm, I sat down to review eight offers on a Regent Park condominium listing of mine, priced at $499,900, eventually selling for $624,000. You’ve heard how insane the condo market was in early-2020, so this should come as no surprise. I was doing offers remotely, and told the buyer’s agent that we had to obtain the deposit cheque that night in order to accept the offer, so didn’t her buyer drive in from Mississauga and hand me the bank draft in person – at my home!

The next morning, the world changed forever.

The provincial government declared a state of emergency, and by Wednesday, Bosley Real Estate (and just about every brokerage in the city) told their employees to go home.

On Wednesday, March 18th, I helped Sneha, my team’s marketing manager, load up her computer, monitors, speakers, et al into her car, and she drove to my house to get a folding card table (that I used to put wings/chips on when I had ‘the guys’ over – something I haven’t done since, thanks to COVID…) so that she could set up her work station at home.

“Don’t worry,” I told her. “I’m sure this will only be for a couple of weeks.”

Sneha moved back into the office five months later in August.

We all remember that first Zoom call, right?

Peeking at what our colleagues were wearing, or what they had in the background of their homes.

“Looking good, Erin,” you’d text your friend from work. “Like your hair this morning!”

You could barely focus on the meeting, you were so busy creeping on the other people on the call. Well, imagine a call with one hundred real estate agents, all with video, and that’s how our brokerage kept in touch, multiple times per week.

On my team, the five of us did Zoom calls daily. But it didn’t change the fact that after March 16th, I didn’t complete another transaction for over one month.

April is usually a busy month for me, as I’ll typically do 8-12 transactions, and my team will do another 8-10 as well. This past April, we did one transaction. That’s where the real estate market went, post-pandemic.

Thursday, March 19th and Friday, March 20th, I worked from home. And on Sunday night, my wife said, “I want to you to go back to work tomorrow morning. I can’t have you around here, moping, dragging ass, and just being miserable.”

She was right, that’s exactly how I acted. And on Monday, March 23rd, I went to work at 290 Merton Street and found not a single person there. I continued to go to work every day for the next six weeks, without seeing a single person.

I won’t lie, folks. There were times when I had nothing to do. I’d write three blogs per week, film Pick5, send out my monthly eNewsletter, email clients, look after upcoming closings, but there was no longer 10-12 hours’ worth of work in a day, and for the latter half of March and the first half of April, I might be at the office for eight hours but I might only have four hours’ worth of work, and it was killing me. I ended up writing an 80,000-word white-paper on collecting sports cards, simply because I wanted to keep my mind sharp, and my writing skills sharper. I turned that into a 200-page book and gave a copy to my father. One day, I’ll look back at it and remember why I wrote it, and where I was in my life.

March 18th, 2020, I wrote “Now What?” which was merely the first of a long run of COVID-themed blog posts.

March 20th, 2020, I wrote, “Coronavirus & Real Estate: FAQ,” and there were 120 comments posted, many of which were calling the end of life as we knew it.

March 26th, 2020, I wrote “The New Real Estate Landscape,” which seemed to have no answer for how and when the real estate market would be back to “normal.”

April 8th, 2020, I wrote “How Are Sales During COVID?” which painted a bleak picture of the real estate market, but did show some upside in certain market segments.

And the posts continued, through April, into May, and as I noted on Monday, ended up taking us on a strange journey into blog posts and videos the likes of which I had never authored before!

The pandemic affected the rental market, the condo market, and the freehold market enough that we dedicated entire sections of these two late-year blogs posts to them. But it affected everything about real estate, from the way we show properties without double-bookings and while sanitizing upon entry, to the way we use wire transfers for deposits instead of bank drafts.

Absolutely, positively everything in real estate was affected by the pandemic, so I could write ten thousand words for point #1, or perhaps, another 200-page book.

Instead, I thought I’d just give you my experience from the first time I heard the word “COVID,” as I’m sure you could tell me yours.

Eek!

Almost three times as long as the average blog post. Sorry for that, but as crazy as this might sound – I don’t know how to get the point across any faster!

I won’t belabour this goodbye, since there’s another one in store for you on Friday.

Kudos to anybody who read this entire post without skimming, and congrats to those who read it a second time just for good measure! 🙂

As with Monday’s post, I’m eager to here if you feel there were more worthy real estate stories in 2020 that didn’t make the list.

Francesca

at 8:07 am

David, my family’s personal situation this year was affected by all your points except for the rental market one.

Because of the pandemic we realized we wanted to be closer to my parents, especially now that my mom’s Alzheimer’s is progressing. My daughter is in grade 8 doing school online and this allowed us to sell our detached suburban home in November rather than wait for the spring as my daughter can continue her online studies from anywhere without changing schools. We sold our house in two days in a bidding war and are now doing the reverse move as your first point. We are the anomaly I guess moving back to Toronto, to North York, to live in a condo with no more outdoor maintenance taking up so much of our time and to be less car dependent We will be 10 minutes from my parents instead of 40 and my husband will be 20 minutes by subway to his midtown construction job vs an hour drive.

As for for your point of not accepting market reality we are seeing so many condos overpriced. We actually put in a fair market offer on a condo this past weekend that had been on the market since March with five price drops already but our offer was refused. The sellers told us they would take it off the market and relist once the vaccine was wildly available in hopes the condo market would rebound. Let’s see if they are right! There seem to be lots of people In denial that the condo market has changed in 12 months. We hope to buy something by March to capitalize the drop in prices. I can see the appeal of cashing out and leaving the city and the GTA entirely but many people have jobs or family situations that don’t allow that and some people like ourselves know we would be bored silly in a small town or rural environment. Everyone’s preferences and circumstances are different.

Chris

at 10:01 am

Yet more evidence that WFH is likely here to stay:

“A majority (52 per cent) of human resources managers said they’ll continue with flexible working policies to support their employees’ work-life balance once the coronavirus pandemic is over

Indeed, 45 per cent of respondents said they’ll continue to offer compressed work weeks, 40 per cent indicated they’ll keep job sharing in place and 41 per cent will make part-time work arrangements permanent.”

https://www.benefitscanada.com/human-resources/other/employers-planning-to-continue-offering-flexible-working-policies-post-pandemic-survey-153293

And ADP presents some data on the employees’ perspective:

“The survey found that 45 percent of working Canadians surveyed say they would prefer to work remotely at least three days a week and more than one quarter would prefer to work flex hours. Respondents, including managers and front-line employees, also said that remote work did not have a significant impact on productivity, quality of work and hours of work.

The younger generation of workers appear particularly drawn to remote work, with 61 percent of workers aged 18 to 34 saying they prefer to work remotely at least three days a week, compared to 43 percent of workers over 35.”

Bal

at 10:27 am

I believe as long as interest rates stay low, housing market will be on fire….I repeat …only and only interest rates impact housing market….

I have been looking for the house and shitty houses are gong over asking with multiple offers…

I will need to wait until 2023 if interest rates will start to move up…otherwise no chance in this environment…

Appraiser

at 2:26 pm

“10-year rates just did the limbo under 2%, for the first time in Canadian history”

ALSO: “The latest on HSBC’s blockbuster 0.99% ”

https://twitter.com/RateSpyref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

“Rate-wise, this may be a once-in-a-generation chance to buy a home.” Rob Carrick !

https://www.theglobeandmail.com/investing/personal-finance/article-rate-wise-this-may-be-a-once-in-a-generation-chance-to-buy-a-home/?cmpid=rss&utm_source=dlvr.it&utm_medium=twitter

Island Home Owner

at 10:48 am

Just FYI, the real estate market on Prince Edward Island is going nuts in 2020 (as it was in 2019 as well …)

YET you would be AMAZED what you can still buy for 1/2 the cost of an east-end semi north of the Danforth.

Jimbo

at 7:47 pm

But they lock everyone out of the island including islanders out of fear. You also have to travel to Nova Scotia for major medical issues.

Island Home Owner

at 8:18 am

And you can drive to Halifax from the lovely downtown house I bought for five figures(!) two years ago in about the time it would take to drive from Oshawa to Oakville if traffic was heavy *shrugs*

Appraiser

at 8:00 am

“December and January are usually the lowest sales months of the year, yet first 15 days of Dec had more 416 condo sales than any month other than March… I can tell you I’m a helluva lot busier than I normally am by this time in December. – Scott Ingram

https://twitter.com/areacode416

Appraiser

at 10:17 am

“The strongest index rise for a month of November”

“In November the Teranet–National Bank National Composite House Price IndexTM was up 0.9% from the previous month, the strongest gain for a month of November in the 22 years of the index. It was the second consecutive month to show the biggest rise in index history for the month in question.” https://housepriceindex.ca/2020/12/november2020/

Appraiser

at 11:37 am

“Why doomsday housing forecasts have proven wrong — for now”

https://financialpost.com/real-estate/why-doomsday-housing-forecasts-have-proven-wrong-for-now

Chris

at 11:40 am

“Why there is no stock market bubble”

https://financialpost.com/financial-times/why-there-is-no-stock-market-bubble

Sounds like similar arguments across both asset classes.

Chris

at 12:40 pm

“U.S. stocks rose to records after data showing a further slowdown in the labor market stoked bets Congressional leaders will clinch a deal on federal spending.”

– BNN Bloomberg

“Bitcoin soars above US$23,000 as more Wall Street firms pile in”

– BNN Bloomberg

“Ontario’s population outright DECLINED last quarter and real estate is surging. Nothing is real in 2020.”

– Ben Rabidoux

Hmm almost seems as though extremely loose monetary and fiscal policy are bolstering asset valuations across the board. Except for condos, of course.

Chris

at 11:39 am

“Canada sees slowest population growth since 1946 on travel bans

The stall highlights the impact COVID-19 is having on Canada’s once-robust population growth, a worrying sign for an economy that relies on immigration for demand and to offset an aging demographic.

Canada welcomed 40,069 immigrants in the third quarter, but reported a record net loss of almost 66,000 non-permanent residents, the agency said.”

– BNN Bloomberg

“This right here is what I’ve been talking about people. Impact of NPRs in driving ACCELERATION in population growth since 2015 has been huge. Now in reverse. Flashback to my earlier thread… ”

– Ben Rabidoux

https://twitter.com/BenRabidoux/status/1339577227311276034

Behind the curve, right?

Chris

at 11:47 am

“After much discussion, Toronto’s City Council voted 24-1 today, approving to move forward with designing a vacant home tax.

The city has only passed a plan to implement the tax, meaning its potential implementation would be expected for 2022.

Mayor John Tory was the last speaker of the meeting and mentioned his goals for the plan.

“I hope there comes a day when it doesn’t raise one cent, not one cent. Because that means it will have been successful in making sure that every housing unit is being used for the purpose for which it was intended, which is for somebody to live in it,” he said.”

https://www.blogto.com/real-estate-toronto/2020/12/city-toronto-votes-implement-vacant-home-tax/

Bal

at 2:29 pm

Govt should also approve speculation tax…lol..people who are holding five houses to flip…will come to know the realty…lol..i don’t know think vacant home tax will be much help to stabilize the house market but I guess it will be helpful for the city…

Clifford

at 2:11 am

Should also tax people for breathing too. This is all getting ridiculous. You charge taxes when you don’t have the intelligence to tackle a problem. Canada’s bread and butter.

Andrew

at 6:52 pm

David your COVID-moustache was kind of a story there until you chickened out and shaved it!