The impact of student loans on buying a home

Housing Wire

MAY 24, 2024

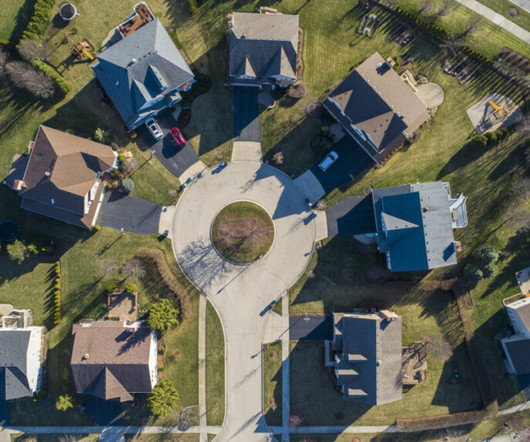

If you’re considering buying a home but worry that student debt will prevent you from securing a mortgage, you’ll need to be strategic about your approach to increase the probability of your application getting approved. A higher credit score is generally associated with high reliability, improving your chances of a mortgage approval.

Let's personalize your content