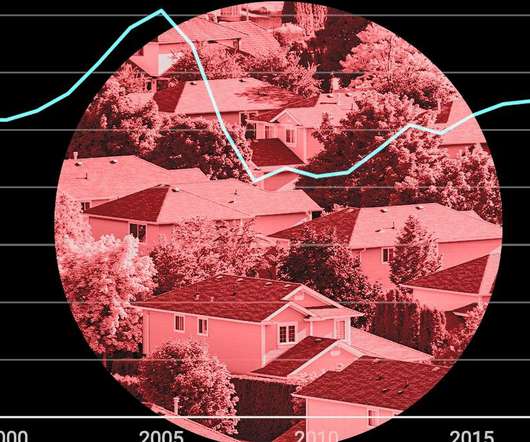

Reverse mortgage volume, securities issuance fall in February

Housing Wire

MARCH 6, 2024

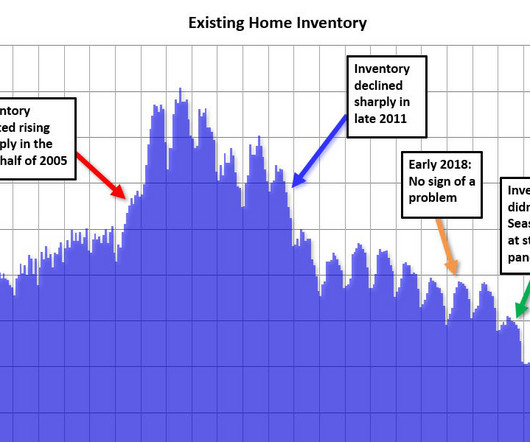

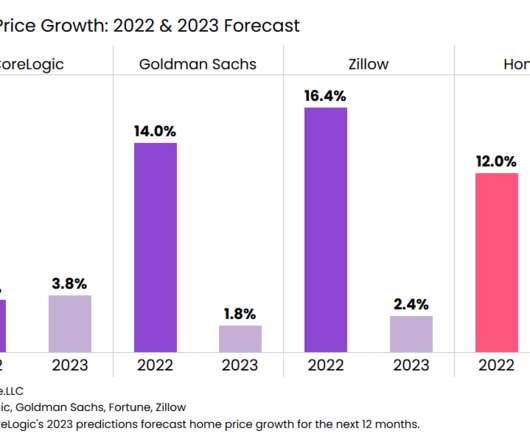

” HMBS issuance will have a fairly long road to recover to 2023 levels, which were already severely reduced from the record-setting issuance of 2022 brought about by elevated HECM-to-HECM refinance activity during the COVID-19 pandemic. and Longbridge Financial recorded increases for the month.

Let's personalize your content