Home equity products light up a dark housing market

Housing Wire

OCTOBER 5, 2023

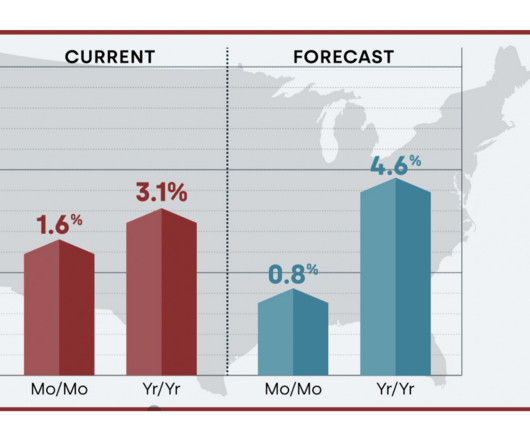

As the housing market suffers through a drought of home sales and related mortgage originations in the current high-rate environment, home prices and home equity continue to climb, helping to spark a revival of another sector — home equity lending and investment. billion, according to a review of bond-rating and industry reports.

Let's personalize your content