United Bank to consolidate its mortgage subsidiaries

Housing Wire

FEBRUARY 1, 2024

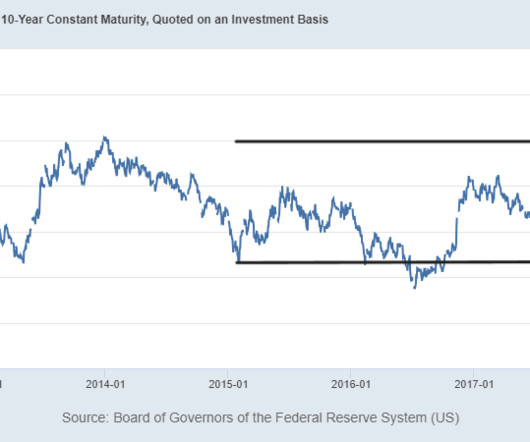

United Bank will consolidate its mortgage subsidiaries into one unified mortgage business amid the housing industry struggles with elevated interest rates. United Bank has been delivering mortgage services through three channels, including two mortgage subsidiaries — Crescent Mortgage Co.

Let's personalize your content