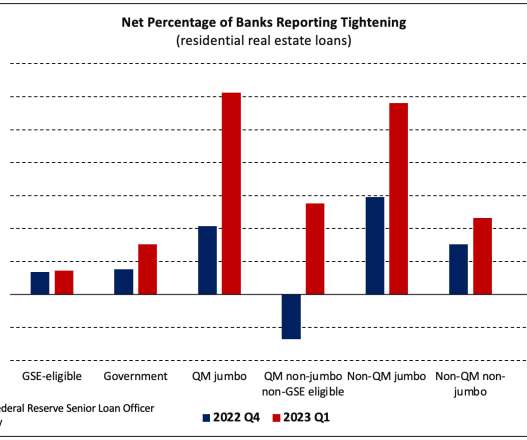

Banks report tightened lending standards for nearly all residential mortgages: Fed survey

Housing Wire

FEBRUARY 6, 2024

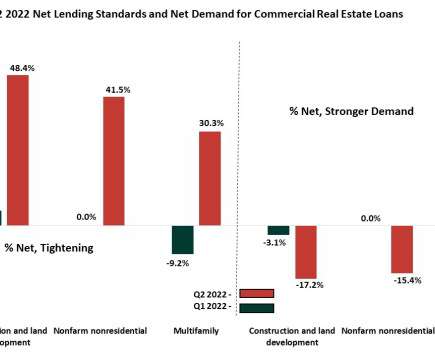

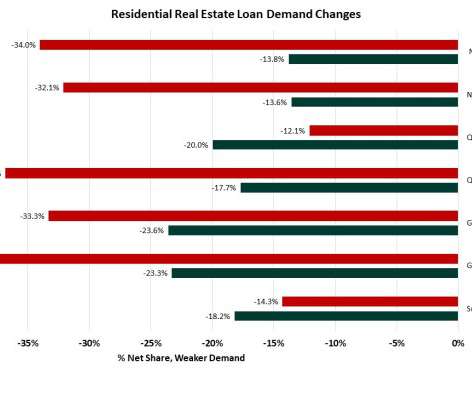

Banks reported having tightened lending standards across almost all categories of residential real estate loans over the fourth quarter of 2023 amid an elevated interest rate environment. banks said they saw weaker demand for all types of residential real estate loans except for government (46.2%) and subprime mortgage loans (41.6%).

Let's personalize your content