3 unique mortgage products to get today’s homebuyer qualified

Housing Wire

FEBRUARY 28, 2024

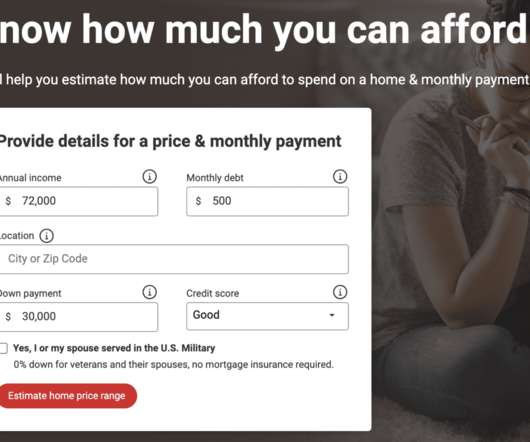

Tom Davis, chief sales officer, Deephaven Mortgage Today’s market means that more borrowers have higher debt-to-income ratios, limited access to credit and are looking for alternative ways to get qualified for a mortgage. HW: Why are DSCR cash flow, bank statement and second lien mortgages popular right now?

Let's personalize your content