Mortgage applications rise to highest level since July 2022

Housing Wire

SEPTEMBER 25, 2024

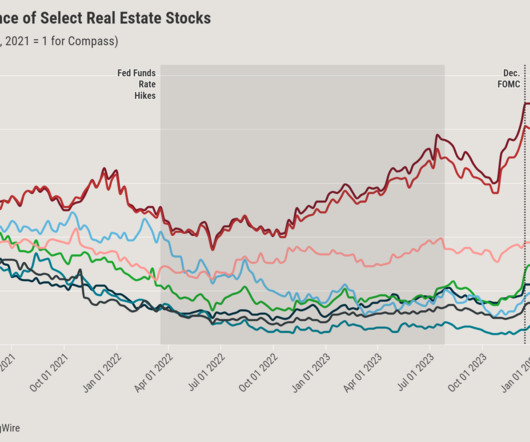

Mortgage applications are now at their highest level in more than two years after an 11% jump during the week ending Sept. 20, according to the newest weekly applications survey from the Mortgage Bankers Association (MBA). Adjustable-rate mortgages (ARMs) accounted for 5.9% on mortgages with 80% loan-to-value ratios.

Let's personalize your content