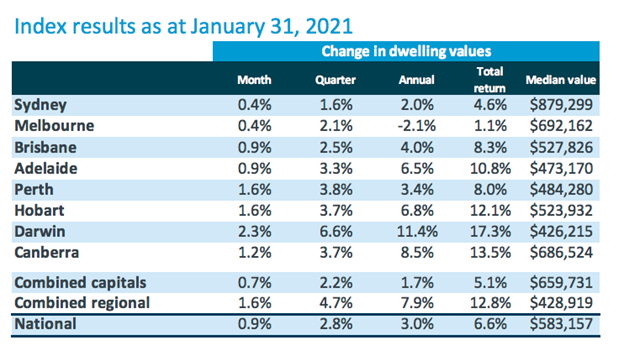

2021 has started in strong fashion as most property markets across the country continue to see rising prices.

According to the latest data from CoreLogic, house prices are up once again in February and it appears that the big banks are also predicting significant price gains over the next 12-24 months.

Month to date, house prices in our major capital cities are 1.2% higher according to CoreLogic, taking the year to date gains to 1.4%. Out of Australia’s five largest cities, Perth has so far been the strongest this year, with gains of 2.4% followed by Brisbane at 1.5%.

Notably, both Perth and Brisbane have avoided the bulk of the lockdown measure with Sydney and Melbourne notably feeling the effects. Similarly, Sydney and Melbourne have also been two of the strongest performers over the past decade.

Rising property prices is also the story that we are hearing out of Australia’s major banks who have recently been updating their property forecasts for 2021 and beyond.

For the most part, the outlook appears to be incredibly strong for homeowners and investors as prices continue to be boosted by record-low interest rates and the fallout from the various Government incentives that we’ve seen over the past 12 months.

Bank Forecasts

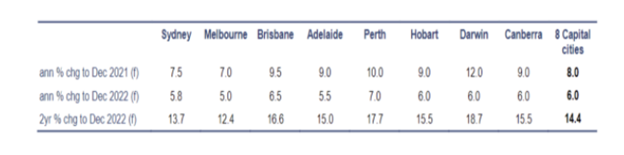

CBA updated its price forecasts recently and it is now very bullish on property across the board. We must note that it was also CBA who was one of the most bearish when COVID first hit and they have now completely changed their tune.

CBA expects house prices in our major capital cities to rise by 8% in 2021 and then by 14% by December 2022.

They are predicting Perth and Darwin to be the strongest markets in 2021, with gains of 10% and 12% respectively.

It’s also worth noting that Perth and Darwin were two markets that have been the hardest hit over the past five years, falling in value, when the East Coast of Australia boomed.

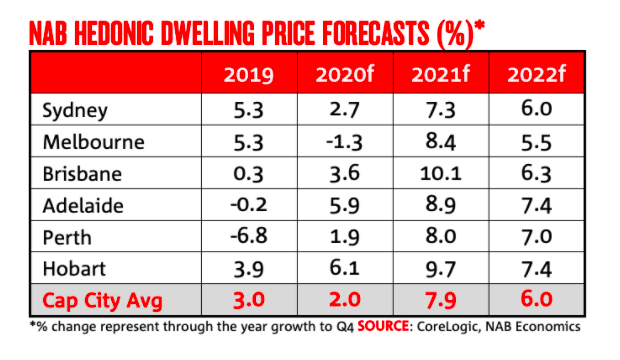

NAB’s price forecasts are also very bullish and are almost in line with that of CBA. NAB is expecting to see house prices rise on average by 7.9% in 2021 and then 6% in 2022.

NAB expects Brisbane and Hobart to be the strongest performed markets in 2021, rising in value by 10.1% and 9.7%.

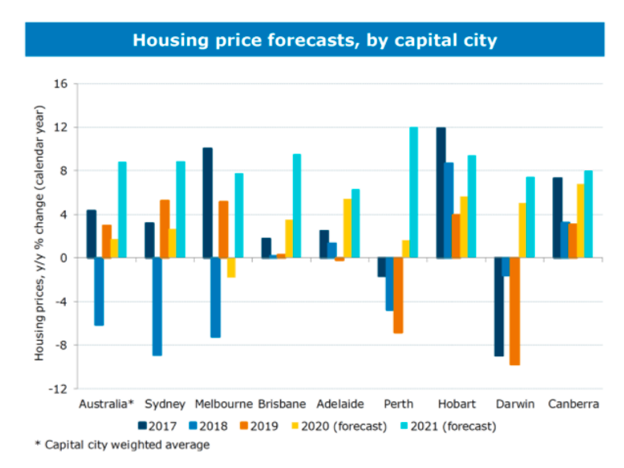

ANZ was one of the first major banks to come out with their bullish predictions and they too are expecting more upside in 2021.

ANZ expects to see Perth property prices to grow by 12%, while Brisbane and Hobart will also see near-on double-digit growth.

So far in 2021, it appears that these forecasts are well and truly on track with prices up around 1.4% so far this year.

At the current rate, we are likely to see prices rising around that 8-10% level, which means homeowners and investors alike are going to be in for a very strong 12 months.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)