Home-equity lending blossomed in 2023

Housing Wire

JANUARY 9, 2024

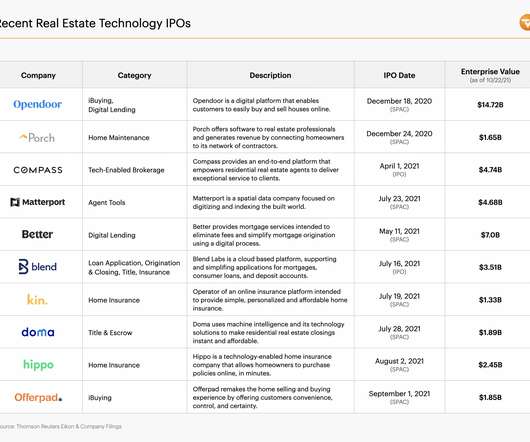

Home-equity lending overall found its wings in 2023 as a number of independent mortgage banks ramped up product lines over the course of the year — despite a bump in the road in the third quarter when mortgage rates surged past 7%. homeowners with outstanding mortgages — some 63% of all homes — home equity tied up in properties jumped by 6.8%

Let's personalize your content