Opinion: The evolution of the independent mortgage bank

Housing Wire

SEPTEMBER 12, 2023

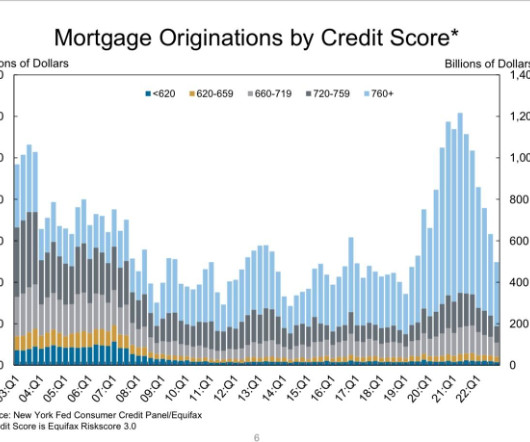

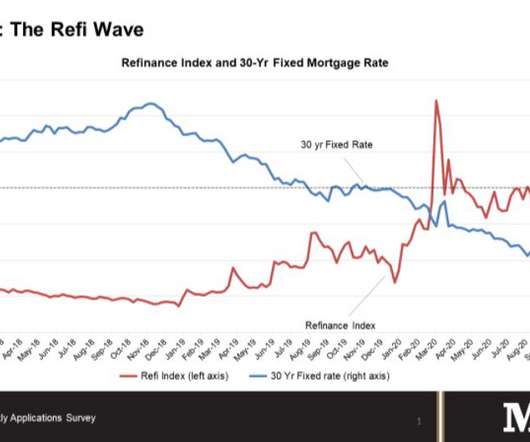

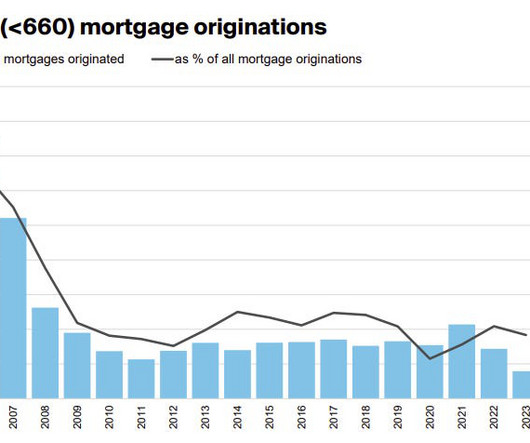

These current mortgage markets are what make it challenging for independent mortgage banks (IMBs). Mortgage loan volume in the second quarter of 2023 was down 56% from the same period last year, according to ATTOM. During this crisis, many savings and loans failed, and the federal government stepped in to bail out the industry.

Let's personalize your content