How the housing market will evolve in 2023

Housing Wire

JANUARY 25, 2023

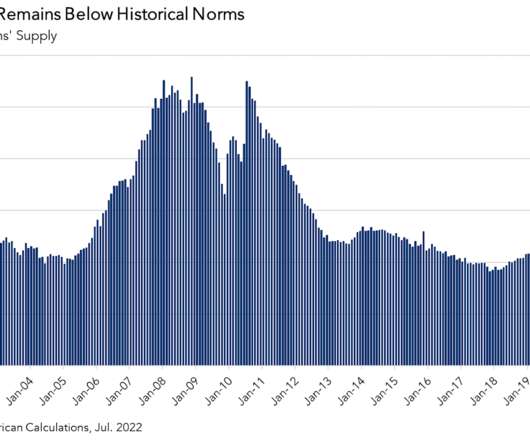

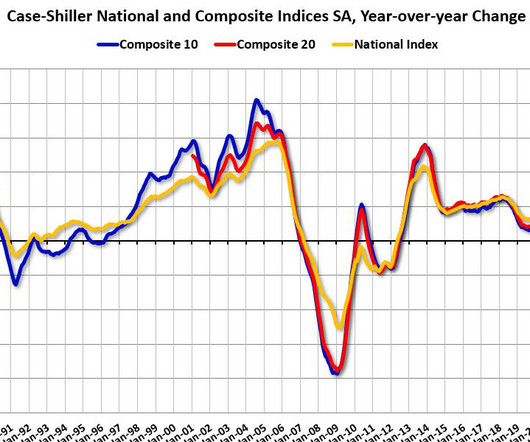

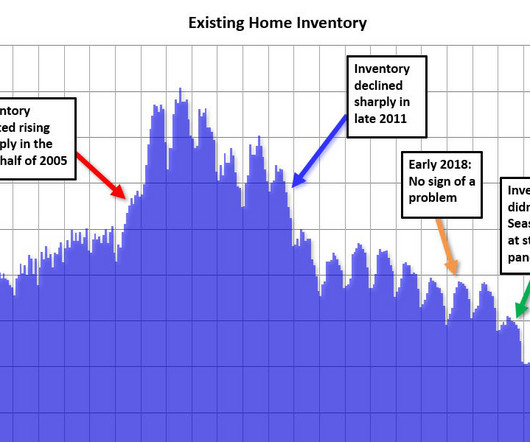

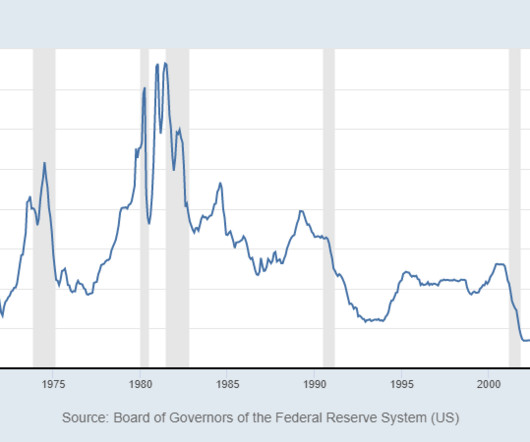

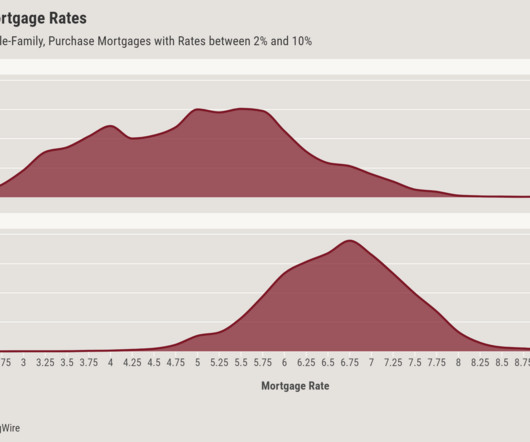

This article is part of our 2022 – 2023 Housing Market Update series. They increased the Federal Funds Rate from nearly 0% at the start of 2022 to 4.5% in December 2022, its highest level since 2007 and its fastest rise in more than 40 years. As inflation eases, so will long term mortgage rates. in September 2022.

Let's personalize your content