Why fewer homes are taking a price cut, even while inventory rises

Housing Wire

FEBRUARY 10, 2024

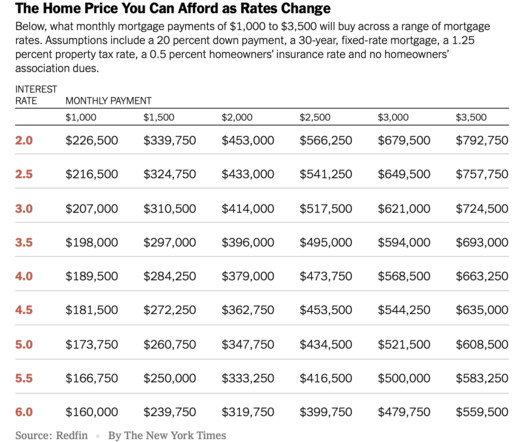

This calls into question a mortgage rate lockdown, as mortgage rates are also higher year over year. However, this data can move stronger in either direction when mortgage rates rise or fall aggressively. Demand is rising from a low bar, and total housing inventory levels are still historically low.

Let's personalize your content