Housing inventory defied all predictions in 2023

Housing Wire

DECEMBER 30, 2023

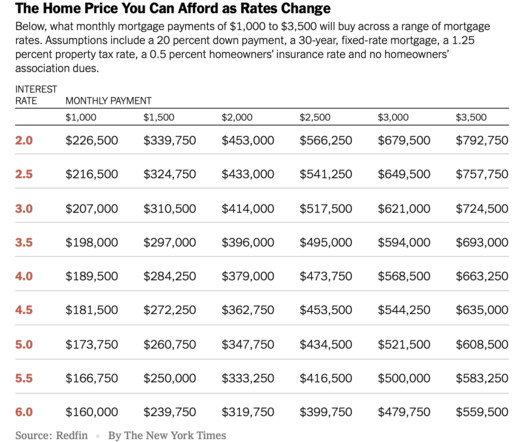

Going into 2023, people thought housing inventory would skyrocket, home prices would crash, and we would see the housing market of 2008 all over again. Looking back on 2023, the inventory story was a big surprise even as mortgage rates headed toward 8%, as the data below will show. 9, 2022, and they’ll be ready for what’s coming next.

Let's personalize your content