Why higher rates aren’t crashing home prices

Housing Wire

JUNE 9, 2023

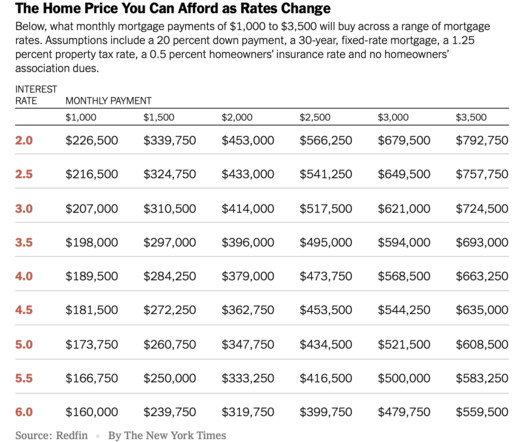

In 2022 it was all about finding a point in time when I thought mortgage rates would fall, which was key to understanding how the purchase application data would react to lower mortgage rates. In 2022, mortgage rates got as high as 7.37%, so the question was: how low do rates have to go for housing demand to get better?

Let's personalize your content