Why are existing home prices rising when sales are still so low?

Housing Wire

APRIL 18, 2024

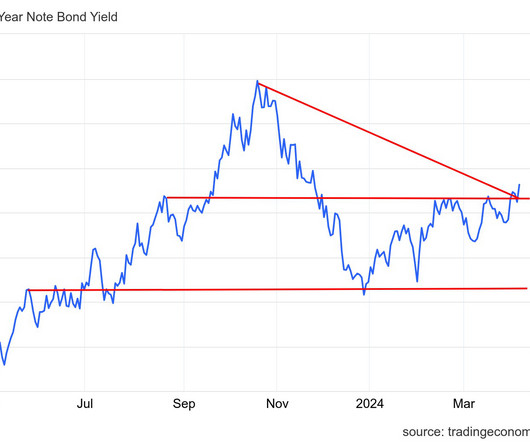

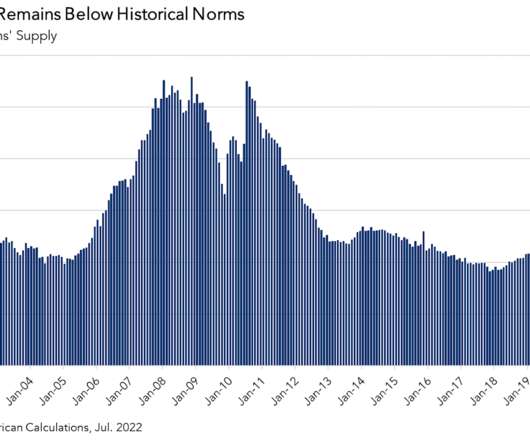

Existing home sales fell in today’s report , which isn’t surprising, but one headline that shocked some people was that home prices are still up year over year, even with higher inventory and higher mortgage rates. from the previous year ($375,300). NAR: Total existing-home sales receded 4.3%

Let's personalize your content