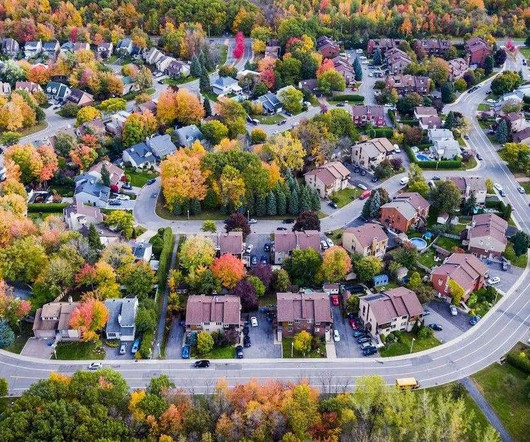

NAF’s Gatling: Recognize that diverse communities are the norm

Housing Wire

APRIL 25, 2024

The way that someone refers to the concept of diverse communities in their interactions with consumers and housing professionals can be a key indicator about their mindset. I feel that in mortgage and real estate, we are still clinging to outdated fair housing terms,” Gatling said during the session. These people are the new majority.”

Let's personalize your content