Borrowers shift toward jumbo loans, ARMs as mortgage rates rise

Housing Wire

MARCH 13, 2023

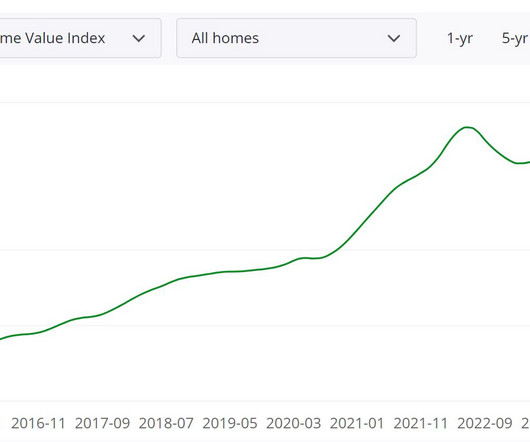

Rate and affordability pressures continue to challenge purchase lending, driving homebuyers to alternative loan products. Pipeline data from February showed overall rate lock dollar volume up 2% from January, with purchase locks rising 4%. Overall lock volumes were up 8.6% over the last three months but remain 58.8%

Let's personalize your content